Online broking and crypto apps have seen a significant increase in the funding boom in the last five years. Funding in India has increased at a CAGR of 98% in the last six years.

We are witnessing increased competition and innovation among fintech startups which has disrupted the traditional financial services industry. It also forced the fintech businesses to scale up their operations. This led them to create multiple options for customers and build experiences that get traders hooked onto their platforms.

No doubt, for fintech brands to remain competitive and relevant in this disruptive market, digital innovation is the key. The webinar on online broking and crypto apps hosted by Netcore Cloud saw a discussion on how online broking and crypto apps can enhance the customer experience across channels with personalized initiatives, taking the help of technology for business growth.

Highlights from the keynote by Umang Soni

For a breakthrough in cracking app onboarding and activation in the world of digital KYC, let’s understand what Umang Soni, Product Head, Zebpay, has to highlight.

With more than 5.5 years of experience in the product domain and over 10+ years of experience in working in mobile-first products, ERP systems, web applications, and mobile applications, he certainly holds expertise in the world of digital innovation.

Let’s look at the highlights from the discussion around app onboarding, app activation, and digital KYC.

Onboarding

A user downloads an app either to solve a problem or to achieve an objective. For effective onboarding, get clear on what problems your app is solving, and what you are helping your users achieve.

Three impactful components under app onboarding that a product company needs to set up are new expectations, new engagement, and faith of the users with that particular brand or product.

Onboarding directly impacts how well you retain users on your app. A seamless app onboarding would leave a good long-term experience even if there were other hiccups. Largely, marketing is about extending experiences, and this starts with app onboarding.

Going further, an important question is, “why would any user want to invest time to download your application?” The app onboarding answers that and defines objectives a user can attain through a particular app.

Activation

App onboarding is all about welcoming the individuals and helping them understand the app, but that alone doesn’t suffice. App activation as the next step plays an even bigger role. Unless onboarded users perform the desired actions (as defined by the product company), the process is not concluded.

KYC and AML

Only after successfully registering on the app, the users become eligible for KYC. And KYC (one-time activity) is a part of anti-money laundering (ongoing activity). AML is an evolving program that is a must for every fintech company.

By connecting data points from KYC, companies create strategies to give more offerings to users. Furthermore, with digital KYC, the conversion time from app download to performing actual transactions has been reduced.

How Netcore Cloud can help online broking and crypto companies retain users

Netcore Cloud is heavily focused on helping broking and crypto companies ‘retain’ traders since retention is the primary profit driver. For FinTech organizations, a 5% increase in customer retention increases profits by 25-95%. At the same time, a 2% increase in customer retention can decrease costs by 10%. Activation is expensive, but retention is really profitable. So you hear the new buzzing phrase, “Retention is the new acquisition.”

On average, loyal customers are worth 10x more than first-time customers.

Moreover, retention also means:

For acing retention, a customer-first mindset is a solution. A customer-first mindset includes omnichannel personalization, contextual engagement across channels, intelligent communications, and finally, delightful product experiences.

All of this results in high spends on acquisition with poor ROI.

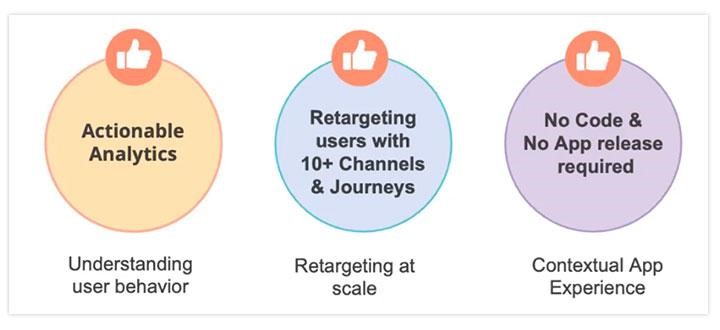

3 ways Netcore Cloud helps in driving retention

- Understanding your user behavior by leveraging actionable insights.

- Retargeting dropped out users with 10 plus channels and automated journeys so that a marketer doesn’t have to manually find out who didn’t complete the KYC.

- Delivering contextual app experiences in a world of hyper-competition with 100s of apps for trading so that your users stick on our app and perform desired actions.

Common challenges faced by fintech marketers

- Lots of dropouts at different stages.

- High uninstall rates.

- Overwhelming information leading to lack of transactions.

- The core value of the app is not seen in the first session.

- Marketers are unable to find the hidden pattern of users.

Here’s how Netcore Cloud analytics make a difference

- User path analysis: Understanding what path the user is taking inside the app is important. For example, what were the 5 events that happened before the user uninstalled the app? Or, in a more positive way, the five actions a user performed before converting.

- Funnel analysis: With funnels, you can understand which city of users are dropping out the most or which mobile OEMs have seen the most uninstalls.

- Cohort analysis: This is used to understand what users do today and how much time they take to return and perform a specific action like signing up for a KYC.

- Segmentation: Is used To understand a group of users performing the same actions.

- Behavior analytics: Understanding user behavior in detail and using it for prediction.

- Predictive analysis: Predicting the user behavior so that you don’t wait for a user to uninstall but predict the user who is going to uninstall or who is going to transact, and nurture them better from Day Zero.

- RFM analysis: It helps you categorize users into loyal users, at risk, on the fence, dormant, needing attention, promising, hesitant, novice, among other things.

Once analysis is taken care of, you can move to engaging users through multiple channels, including app push notifications, in-app messages, web push notifications, FB messenger, SMS, email, WhatsApp, and more.

But of course, we cannot use them all at once to engage users at scale. So how do we do it? For example, when an email is sent but not opened, we can trigger a push. If the push is not clicked, we can engage via SMS, and so on.

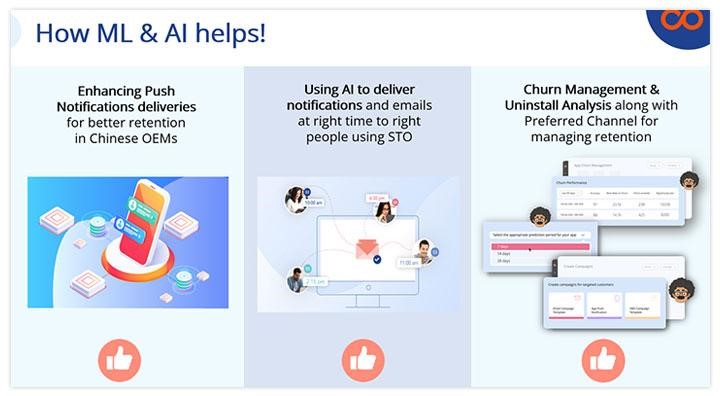

Role of AI and ML

AI/ML, too, plays a crucial role here. For starters, it helps you enhance push notifications deliveries for better retention in Chinese OEMs. It also enables you to send push notifications to the right people at the right time using Send Time Optimization (STO).

ML analyzes all the open rates, click rates, engagement, conversion activities across platforms and channels to understand the right time.

Lastly, ML helps you dive deep into churn management and uninstall analysis along with preferred channels to manage retention.

Netcore Cloud’s contextual nudges and walkthroughs

This is where most fintech companies lack and exactly where Netcore Cloud can help—contextual nudges and walkthroughs.

Contextual nudges and walkthroughs help effectively achieve intelligent onboarding, relevant feature discovery plus adoption, driving high engagement, forming habit-loops, and experimenting with experiences.

Netcore Cloud has witnessed an 82% uplift in CTR of a new feature with a Contextual Spotlight. Plus, contextually nudged users enjoyed a 25% increase in registrations. To level up, we can provide local language nudges for contextual registration and KYC completion. Adding those bank accounts can be done in the same session by guiding users on what to do. You can do all of this without any code. To implement such experiments, it is essential that instead of going to the engineering team and following a 15-20 days review cycle, marketers can test under 15 minutes and wait for 15 days to see results.

And that’s precisely what Netcore Cloud can help you achieve.

A Netcore Cloud stack includes analytics from the base, retargeting via customer engagement, personalization across channels, and improving those product experiences with the intelligence of our AI engine called Raman, plus bringing in some platform APIs.

Panel discussion on ‘Building experiences that get traders hooked on to your app’

Members:

- Umang Soni, Head of Product – ZebPay

- Harsh Vardhan, AVP – Product Management – Fintech – Yes Securities

- Arpit Khurana, Senior Product Specialist – Netcore Cloud

- Nandkishore Purohit, Chief Digital Officer – IIFL

- Abhinav Kashyap, Growth strategy and Sales Head – Dhani

- Raminder Anand, VP Marketing – Mastertrust

- Aditya Gupta, Assistant Vice President Marketing – SBICAP Securities

- Dipayan Kothari, DVP Products (Equity & Alternates) Private wealth – Edelweiss Wealth Management

- Minal Thukral, Head of Growth – CoinDCX

Question 1

What are some top industry challenges of online broking and crypto, and what are some things that FinTech apps or FinTech companies should be ready for in the next one to two years, given the situation of 2020 and 2021?

There are three types of brokers into traditional brokers, bank-based, and discount brokers. Over the last five years, the discount brokers have gained market share expedited by the COVID crisis. They played on two things—discounted fees and open architecture. In the coming years, we can expect similar exponential growth. We will also witness traditional, bank-based, and discounted brokers coming together to start using technology and investment products. They will build all of it on one platform that is an open architecture, low in cost, and a one-stop-shop for the customer.

“We are looking at having the entire investment suite into one particular app in the next couple of years to come.” Also, product innovation has become critical. You cannot expect a millennial investor to get hooked to your app by not having access to the entire investment suite – an app that gets them access to everything at a reasonable cost.

– Dipayan Kothari, DVP Products (Equity & Alternates) Private wealth – Edelweiss Wealth Management

“Spending on acquisition cost aside; the biggest challenge is cracking the engagement code.” With increasing acquisition costs, the challenge of the coming years is not to acquire customers but to make the app profitable by engaging them.

– Nandkishore Purohit, Chief Digital Officer – IIFL

Question 2

Given that not more than four percent of the Indian population invests in equity, what strategies have FinTech organizations worked on to expand the user base in India?

A traditional method is hiring some salespeople and driving acquisitions, but spending a certain amount and acquiring new customers comes into play in the digital era. Then there is the solutions approach where we create a persona of a particular section of these traders and investors, acquire new customers, and increase the market size. “Broadly, the growth happens more at a collective level involving brokers, institutions, governments, and regulators at the policy level.”

– Raminder Anand, VP Marketing – Mastertrust

India is on the cusp of adopting personal finance. We found an age gap between the average age of a crypto user to a traditional equity user. “As an institution, broker, or exchange in the industry, don’t just look at acquiring users, do a lot of awareness and education about the asset class you’re offering to users. This way, you’re not just looking at increasing your user base but at expanding the industry or the marketplace as a whole.” Another strategy is to try and replicate offline word-of-mouth behaviors and add them to your product via referral programs so that your users are marketing for yourself, the product, and the industry.

– Minal Thukral, Head of Growth – CoinDCX

“Potential customers need to know what they are missing out on by not investing.”

– Harsh Vardhan, AVP – Product Management – Fintech – Yes Securities

The two biggest objections customers bring in are that they feel investing in equity requires a massive sum of money, and second, investment is difficult to comprehend. These two objections can be solved by introducing simplicity and affordability into our products. That’s exactly what Google Pay and Phone Pay did with UPI transactions. We would also want to educate customers that apart from generating wealth, investment is about growing money in a day or a week, a month, or 10 years. “Simplicity and affordability will help us grow this market.”

– Nandkishore Purohit, Chief Digital Officer – IIFL

Question 3

How do FinTech companies enable themselves for the digital world?

Once you decide upon the pain points your product will solve, you have to look at technology holistically. “Speed, reliability, relevant content, right integration, live experiences, and personalization complete the journey of your success with technology.”

Companies leveraging machine learning have the competitive advantage of making, say, 100 decisions per second compared to bureaucratic companies making 1 decision per day.

– Harsh Vardhan, AVP, Product Management – Fintech – Yes Securities

Experimentation with the user to drive a lot of innovation and personalization is crucial. Along with that, “building core value, driving recurring usage of that core value, and driving feature importance is critical.”

– Minal Thukral, Head of Growth – CoinDCX

“In-house experimentation is profitable but time taking. Thus from an ROI and immediate growth perspective, the right tools like Netcore can make a significant difference.”

– Arpit Khurana, Senior Product Specialist – Netcore

Analytics-enabled cloud-native infrastructure is the way to serve at a scale where the entire cloud-native architecture has to sit on an analytics-driven data lake and data warehouse for us to learn and act in real-time.

– Nandkishore Purohit, Chief Digital Officer – IIFL

Question 4

How to onboard correctly and make sure that the transaction is happening in a limited period? And how do we make sure that the user is hooked to our app for primary trading?

Organizations must ask themselves how automated they are while starting engagement? What engagement strategies are they using, and what kind of communications or engagement content are they using to engage with them? “If a person starts investing in your guest market, then how quickly you are nudging them to engage with your company.” Are they using IPOs? mutual funds? And if they are investing in mutual funds, then how you are driving them towards the cash market and derivative markets.

– Aditya Gupta, Assistant Vice President Marketing – SBICAP Securities

To onboard correctly and get the first transaction, instead of treating onboarding as a separate process, make it a part of the user’s buying journey. Focus on how you can get the trader to start investing (and fulfill their primary purpose on your app). Starting users’ journey with onboarding means it’s during the buying process that you ask them the onboarding questions. And thus, the first purchase is made in, say, six clicks; the next purchase is in a single click.

– Nandkishore Purohit, Chief Digital Officer – IIFL

“To get the user hooked on your app, focus on three parameters – speed, performance, and availability. Personalization. Gamification.”

– Harsh Vardhan, AVP – Product Management – Fintech – Yes Securities

Final thoughts

As we saw, digital innovation is indeed the key to building delightful customer experiences. To get traders hooked on your app, start with answering “why” would any trader want to invest time to download your application? Build upon that by extending awareness, proper onboarding, building trust, and equipping your investors with relevant information. Done right, broking and crypto will encourage users to adopt modern investing instruments beyond traditional banking.

To help in this journey, Netcore Cloud offers no-code solutions to product managers and marketers. Our suite of features includes intelligent analytics, personalization at scale, omnichannel engagement, and product experience, all powered by the Raman AI engine.