Customer Lifetime Value (CLV) indicates the customer’s affinity toward your brand. But not all types of customers hold equal value for your business. Given that it’s 5X less expensive to retain existing customers than to acquire new ones, and a higher CLV = more loyal customers, improving your CLV is vital to the success of your business.

The best way to do this is to build loyalty and engagement and see how successful brands do it. Is it their personalized 1:1 communication? Timely discount coupons? Great product recommendation? Or a combination of multiple things to create the most accessible and smooth purchasing experience for their customer? The answer is all of these and more.

We’ll discuss CLV fundamentals and move to the top seven actionable strategies to improve your CLV.

What is the customer lifetime value (CLV)?

Customer lifetime value is the total amount of money an average customer is predicted to spend on your business during their entire business relationship. CLV can be a good north-star metric, and understanding this will help you make better decisions about the investment ratio between acquiring new customers and retaining old ones.

In addition to measuring the sales you can generate from an average customer throughout, CLV indicates the customer’s relationship with your brand. And the better the relationship, the higher the customer lifetime value and the profits.

Why is customer lifetime value important for your business?

In-depth CLV analysis reveals your highest value customers. These customers have the highest interaction with your brand and make repeat purchases. Analyzing their unique behavior at every stage of their journey and leveraging that analysis for your other customers will help you convert, engage and retain more customers.

What more steps can you take to arrest churn and uplift engagement?

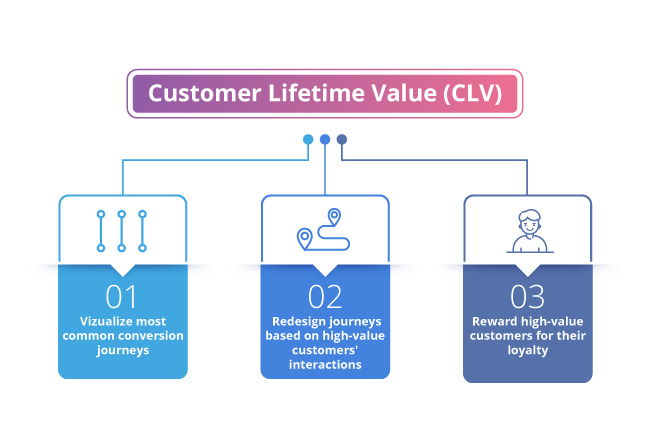

- Visualize the most common conversion journeys.

- Redesign journeys based on your high-value customers’ friction and engagement points.

- Target your high-value (and other) customers with relevant messaging to extend their relationship with your brand and reward them for their loyalty.

Lifetime customer value formula

Calculating the lifetime value is relatively straightforward.

LTV = avg value of a purchase * frequency * years retained

LTV calculates the lifetime spend of customers in aggregate, whereas CLTV is calculated for individual customers.

Also, LTV shows the gross revenue and does not consider the operational expenses, COGS, and other associated expenses. So, customer lifetime value (CLV) shows more transparency.

CLV = LTV * Profit margin

There is no definite number to indicate high or low CLV. It varies depending on the industry, customer demographics, purchasing power, frequency, retention period, and other factors.

For example, a teenager who shops from your apparel brand might be worth:

$50 average purchase value * 8 apparel pieces per year * 6 years = $2400

While adult professionals might be worth:

$120 average purchase value * 4 apparel pieces per year * 15 years = $7200

Adult professionals have a higher CLV in this case as they buy more expensive items, prefer quality, and are likely to stay loyal to a brand. In contrast, teenagers have a low CLV as they buy budget-friendly clothes and experiment frequently.

How to increase customer lifetime value?

Increasing your CLV is known to increase your revenue over time. Longer the customer’s lifecycle, the more value they are likely to bring to your business. Also, analyzing your CLV and devising strategies to fix churn will boost customer loyalty and retention. Increasing your CLV can also help you combat one of the most important struggles for brands now—high CAC. High CLV means more retained customers, higher profit margins (a 5% increase in retention rate can lead to a 25-95% increase in profit), and reduced CAC.

Here are six tested strategies to help you increase the customer lifetime value by improving your customer’s business relationship.

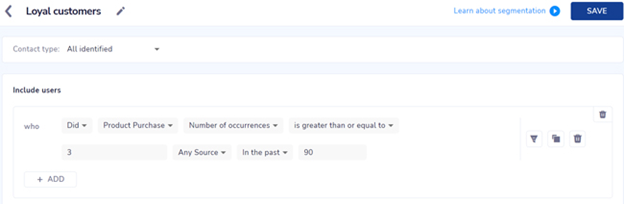

1. Create the right segments

You can use customer lifetime value to segment your customers. Identifying user paths, friction points, reasons for churn, highest engagement points, and more for each segment will help you target them with contextual and personalized messaging and discounts. This significantly boosts customer engagement and loyalty, thereby increasing CLV.

Segmenting your customers also helps you identify your highest-value customer segments. You can then analyze what works best and leverage that to retain your best customers, convert others into high-value customers and acquire and retain new ones. And more high-value customers + high retention = high CLV across your customer base.

2. Customer engagement

High customer engagement positively affects customer lifetime value. So how do you improve customer engagement?

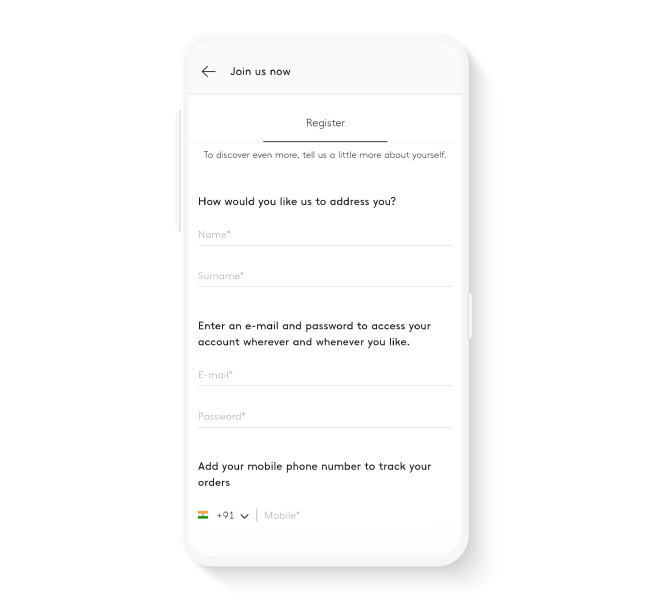

You begin with collecting more communication channels like email and phone numbers while onboarding a customer, as shown below.

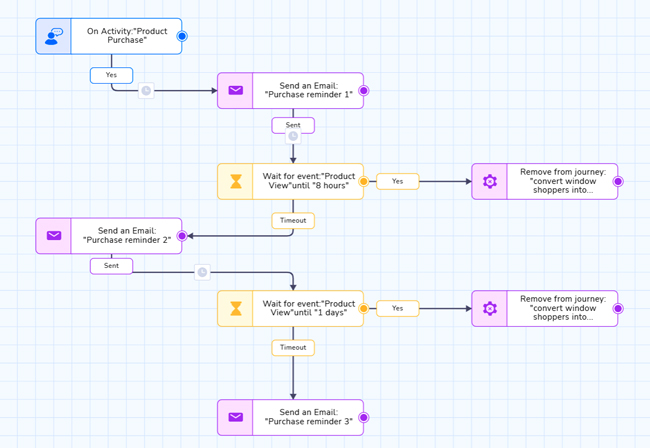

Move on to building a 360-degree customer profile by stitching data from various touch points like the app, website, and social media. And keep tweaking your strategy based on customer behavior across their journey. This is an example of a journey where different emails are triggered based on various factors:

Also, leverage predictive analytics to identify and engage users who are more likely to engage or at-risk users who are about to churn.

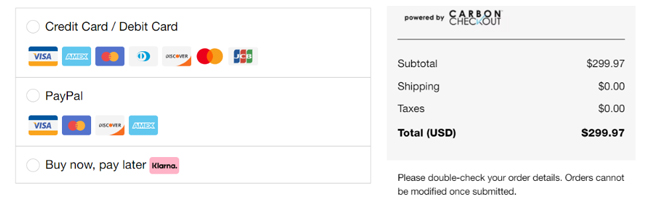

3. Simplify purchases

Simplifying the checkout and payment process lowers cart abandonment and encourages customers to make repeat purchases, increasing the CLV. Securely saving payment details, providing multiple payment options, automatically filling payment fields to reduce payment errors, and enabling users to pay with a click all contribute to effortless checkouts.

For example, Skullcandy simplifies purchases by allowing users to checkout as guests and saves the customer’s payment details. They have to enter payment details only once, and multiple payment options add to the seamless experience.

4. Stellar customer support

Customer service is a deciding factor for 90% of Americans when choosing to do business with a company. And 93% of customers will make repeat purchases from a brand that offers great customer support. The quality of your relationships with your customers is directly proportional to CLV. And excellent customer support is one of the top ways to prioritize and value your customers, reduce churn, and build long-lasting relationships.

How do you offer excellent customer support? It begins with great product quality, so your customers keep returning to you.

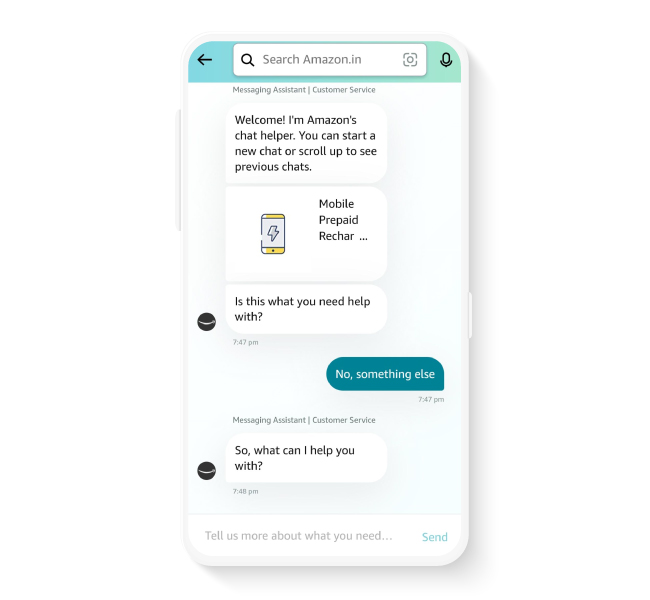

For example, Amazon is widely known as a leader in customer service. Why?

- Hassle-free delivery, returns, and refunds.

- Excellent product experience (Amazon app) with guided navigation, smart search, and relevant recommendations.

- And quick query resolution with AmazonHelp working on Twitter seven days a week in 12 global languages.

All add up to making Amazon’s customer service exceptional. This contributed to a great customer experience and high CLV. Amazon maintained the lead over Flipkart, and its revenue from the Indian marketplace surged 49% in FY 2021.

Also, make it easy for customers to reach out by setting up an omnichannel customer service that offers support through multiple channels like phone, WhatsApp, and emails. 88% of customers expect an email response within an hour, so you want to shorten your response timings. Automating responses to general queries via a chatbot, leveraging a knowledge base on your website/app, and a live chat feature will help here.

5. Loyalty programs

Loyalty perks drive almost 75% of customer engagement.

And high engagement = high retention = high customer lifetime value.

Loyalty programs incentivize repeat purchases and drive higher CLV.

What do the most successful loyalty programs have in common?

- All of them offer outstanding rewards 57% of customers participate in a loyalty program to save money, which you should offer them. Exclusive or custom products also motivate customers to engage frequently.

- Given that 89% of Americans can switch brands to support a cause, loyalty programs that help your customers become a part of a bigger cause work exceptionally well. TOMS, for example, empowers members to redeem points towards a charitable cause like a $25 donation to support school development programs.

- The most successful loyalty programs do not just reward customers for purchases but also for writing reviews, watching a video, following you on social media, and other non-monetary activities.

For example, Sephora runs an omnichannel loyalty program where every dollar spent, online or offline, is equal to the points earned. It divides the customers into tiers as per points earned and offers exclusive and unique benefits—from personalized offers, discounts, and birthday surprise products to bespoke sessions from leading make-up professionals. This keeps customers engaged and compels them to become repeat purchasers resulting in 17 million members in North America alone who drive 80% of Sephora’s sales.

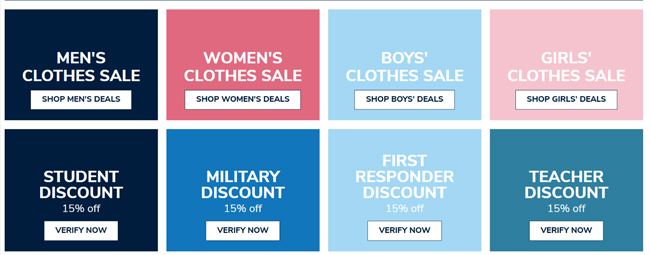

6. Discounts

Well-timed discounts to the right customers encourage them to make repeated purchases resulting in a higher CLV. Segmenting your customers based on their discount affinity (high, medium, low) will help you form a successful discount strategy to concentrate your marketing efforts in the right direction. For example, you can give discounts only to discount-driven shoppers instead of all of them. Offering discounts on specific occasions like birthdays, items added to the wishlist, or items in an abandoned cart are most likely to encourage new and existing customers to purchase and keep coming back for more, leading to a higher CLV.

For example, Vineyard Vines offers unique special discounts on their clothing range for teachers, veterans, students, and first responders to engage and drive these segments to make repeated purchases.

Crocs offers a discount to first-time users to engage and encourage them to purchase again. Such offers can increase CLV.

7. Increase average cart value

Repetitive purchases are not the only way to increase CLV. Increasing the average cart value whenever your customers buy with upselling and cross-selling is highly effective. This would potentially increase the AOV every time your customers buy, leading to an increased CLV. McKinsey reveals that cross-selling can increase sales and profits by 20% and 30%, respectively. However, note that random recommendations wouldn’t work. You need to target these users with relevant and personalized recommendations as per their history.

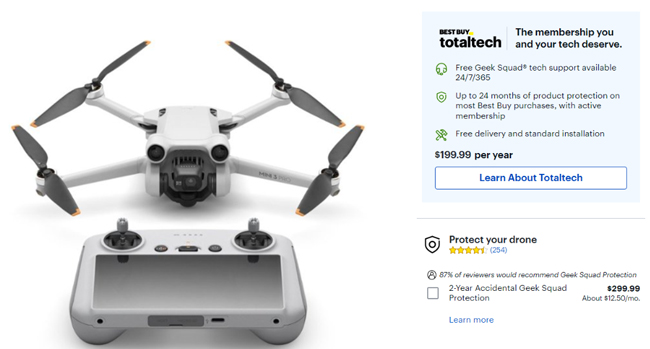

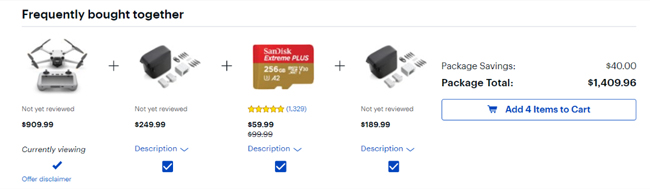

For example, BestBuy cross-sells insurance, protection plans, and complimentary items (frequently bought together) with electronics that customers add to their cart, driving a higher AOV and CLV.

Conclusion

Increasing the CLV essentially boils down to creating and maintaining great customer relationships. Customers need to be at the heart of your strategies—the better the relationships, the longer they last, and the higher the CLV. Making the purchase experience convenient for the customer, making them feel understood, offering what they are looking for, and providing outstanding customer support will improve your CLV because it enhances your customer relationship. You can optimize your marketing budget for optimum results with a thorough understanding of your CAC and CLV.

To know more about how Netcore’s customer engagement platform can help your brand create and maintain these relationships, visit our CEP page.