The shift from conventional banking to digital services has disrupted the way banks and financial institutions operate today.

Financial institutions are leaving behind paper-driven processes that rely on individuals to see them through. They embrace digital journeys that reduce friction and touchpoints to create seamless onboarding experiences.

If you’re seeing drop-offs during onboarding, you’re not alone. But with the right strategies—and the right tools—you can transform this critical phase into a growth engine.

Here are three proven onboarding strategies with examples that will help you stop losing valuable leads and start accelerating fintech growth.

Why Fintech Onboarding Is High-Stakes

This shift from offline to online services via websites and mobile apps demands a seamless experience. Onboarding is the first step in the customer journey. Your onboarding experience is the moment of truth.

It isn’t a simple sign-up. It involves identity verification, financial compliance, education, and emotional trust—all in a matter of minutes.

Users expect:

- Fast sign-up with minimal friction

- Transparency about what data is being collected

- Clear guidance on what comes next

- Reassurance about safety and compliance

In fact, research indicates that 70% of users drop off if any of the above steps are missing.

A successful onboarding experience

- Familiarizes users with navigating the app

- Educate them about the products and services offered

- Effectively converts users into loyal customers

Top Strategies to Improve Engagement via Customer Onboarding

1. Boost App Stickiness via Nudges

App stickiness determines how frequently users engage with your app. The smoother and more intuitive the onboarding process, the higher your app’s stickiness.

This ensures users complete the entire onboarding process, such as KYC registrations, and activates users by guiding them through the app to complete their first transaction.

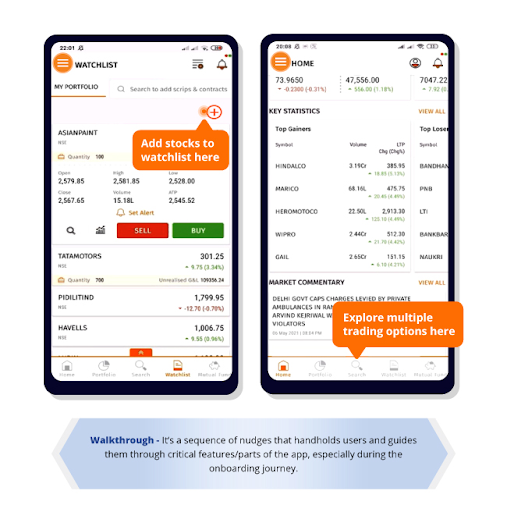

A nudge inside your app or website is that gentle tap on the shoulder—just enough to guide users toward the next best action, without disrupting their flow. Whether it’s a visual cue, a hint, or a subtle message, it always fits the moment and meets the user right where they are.

These nudges aren’t one-size-fits-all. They flex in form—some guide users step-by-step, others simply inform. Want to guide users to complete the desired process? An instructional nudge gets the job done. Rolling out a new feature? An informative nudge explains what it does and how to use it—no confusion, just clarity.

How it helps:

- Nudges deliver a hassle-free user experience

- They are more versatile and user-friendly

- Nudges tackle latency and provide uninterrupted experience without any internet connectivity needs

Case Study: How this Fintech Company Witnessed 21% Increase in New Feature Adoption Using Nudges

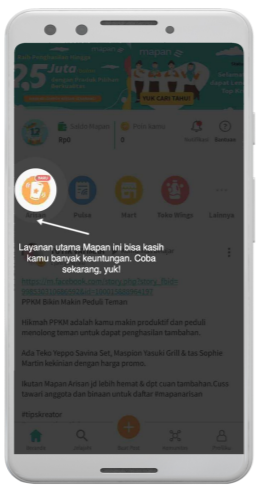

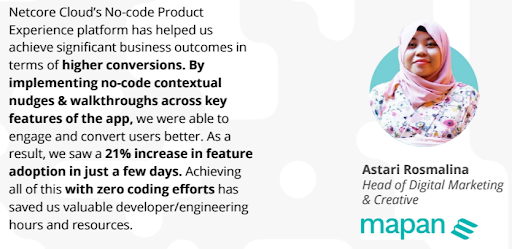

Mapan is a community-based fintech company in Indonesia that empowers hundreds of thousands of low- to middle-income families by providing better access to essential products and services through the power of technology.

Mapan faced low feature discovery and adoption for its flagship service, Arisan. New users often dropped off before engaging with the feature, limiting the service’s potential to drive early user activation and referrals.

To address this, Mapan leveraged Netcore’s no-code customer engagement platform to deploy a spotlight nudge targeted at its new user segment. The goal was to guide users toward discovering the Arisan feature and encourage them to create their first groups—all without relying on developer resources.

The strategy delivered impressive results:

- 21% uplift in users clicking on the Arisan service feature

- Noticeable increase in first-time group creation

- Accelerated user activation and smoother onboarding journey

Mapan also boosted user acquisition through referrals by leveraging Netcore’s targeted nudges.

Read the entire success story with live screenshots of how Mapan leveraged Nudges to boosted user acquisition

2. Leverage Rich Push Notifications for 30% Higher CTRs

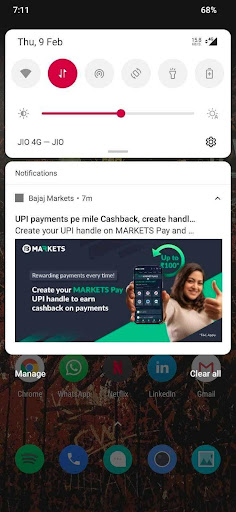

Push notifications are an effective way to keep users engaged and bring them back to your app. Subtle, top-of-screen reminders—prompting users to check the app for updates, promotions, and more—consistently capture attention every time they glance at their phone.

These unobtrusive notifications provide a cost-effective way to plug gaps in your marketing funnel, while also enhancing user onboarding and boosting engagement in ways that traditional channels often can’t.

Netcore’s rich push notifications platform has proven to yield exceptional results, such as

- 30% higher CTR than normal push notifications

- Boost delivery rates across devices by up to 45%

Case Study: Bajaj Finserv Increase Incremental CTRs by 17% via Push Notifications

Despite consistent campaign efforts, Bajaj Finserv struggled to drive higher click-through rates (CTR) across multiple product categories. Additionally, there was a pressing need to personalize messaging to improve engagement and encourage deeper interaction.

To address engagement challenges and optimize campaign performance, the brand implemented Netcore’s Co-Marketer’s Content Generator—an AI-powered tool designed to elevate messaging through smart automation and personalization in their push notifications.

- Data-Driven Optimization: AI-generated variations of titles and messages were tested to maximize open and click rates, leading to stronger engagement and improved conversions.

- Personalized Messaging: Messaging was tailored to user behavior and product preferences, creating more relevant and compelling experiences across different segments.

- Optimized Intelligence: With just a prompt, the team crafted high-performing, personalized content using natural language processing and historical data—ensuring consistent quality and long-term impact without manual effort.

The strategy delivered measurable results:

- 9.78% increase in click-through rates (CTR)

- 17.38% month-on-month growth in clicks

- 4.06% uplift in lead generation

3. Enrich Existing Data through Zero Party Data Collection

Fintech onboarding can be complex—users need to complete re-KYC, link financial accounts, and explore key features before seeing value. But most drop-offs happen before users hit that “aha” moment.

How Data-Enriching and Recommendations Help?

1. Collect Richer Data, Earlier

Chatbots embedded in AMP emails and email campaigns allow fintech brands to collect valuable user data—such as interests, goals, or onboarding preferences—before the user even opens the app. This early data enrichment helps personalize the in-app experience from the first touchpoint, reducing friction and increasing the likelihood of conversion.

2. Personalize Onboarding Journeys

With enriched profiles, fintech apps can dynamically adapt onboarding flows. For instance, users who show interest in investment features can be guided to explore mutual fund tools right after signing in. This creates a more relevant, intuitive onboarding experience that accelerates time-to-value.

3. Engage Users Across Channels

Omnichannel product recommendations—delivered via push notifications, WhatsApp, or in-app messages—keep users engaged throughout onboarding. These messages are driven by chatbot interactions and behavioral data, ensuring every nudge is timely and personalized to user needs.

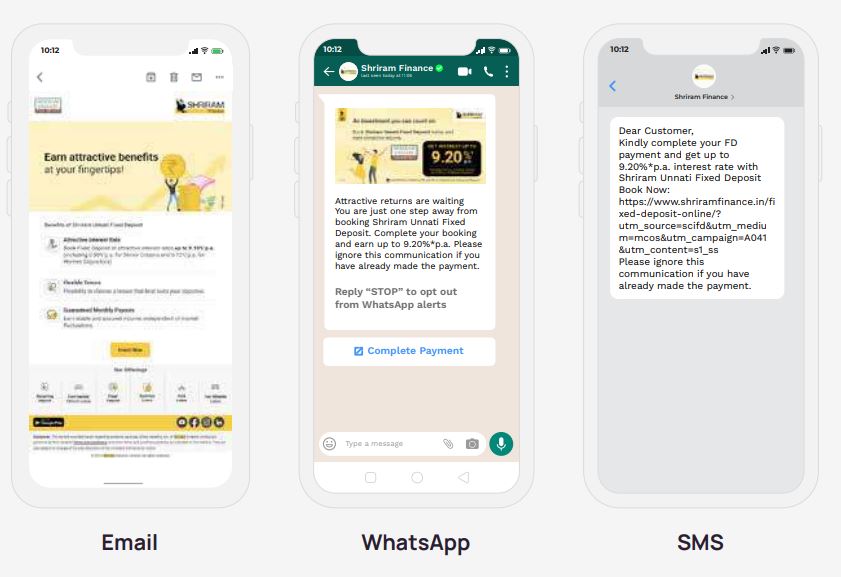

Case Study: Shriram Finance achieves 81x ROI using Netcore’s Marketing Automation Platform

The company aimed to improve core marketing metrics—such as open rates, click-through rates, and engagement—to drive stronger revenue growth.

Additionally, they needed to enhance the customer experience across the journey by addressing drop-off points, and expand their reach through more effective communication strategies.

Netcore stepped in with a comprehensive approach:

- To boost marketing performance, Netcore optimized messaging and campaign strategies to increase email open rates, click rates, and engagement.

- To improve customer experience, Netcore automated critical touchpoints across the user journey, creating a seamless and consistent interaction flow to reduce drop-offs.

- To scale communication efforts, Netcore implemented an omnichannel marketing strategy—leveraging multiple channels and refining targeting/retargeting tactics for higher campaign impact.

The impact?

“Netcore’s solutions delivered exceptional results: 81X ROI, tripled leads, and 15% lower Cost of Acquisition. Their Full Stack Automation Marketing Platform was pivotal in elevating our performance significantly.” – Manoj Kumar, Director

Shriram Finance achieves an impressive 81X ROI using Netcore’s Full Stack Automation Marketing Platform

Final Thoughts: Make Onboarding Your Growth Lever

Your onboarding experience is the first moment your users meet your brand in action. Make it seamless, make it smart, and above all—make it personalized.

With Netcore, fintech marketers and product teams can:

✅ Design frictionless onboarding flows

✅ Personalize every step with behavioral data

✅ Re-engage intelligently with omnichannel automation

✅ Reduce drop-offs and boost activation metrics

Worried About Your AI Marketing Strategy? Read the Agentic Marketing 2026 Predictions Report! →

Worried About Your AI Marketing Strategy? Read the Agentic Marketing 2026 Predictions Report! →