In the fiercely competitive fintech arena, where user acquisition and retention are paramount, standing out requires more than just a compelling product. This success story delves into how one of India’s leading fintech platforms leveraged the power of personalized customer engagement to achieve remarkable growth. By harnessing Netcore Cloud’s Customer Engagement Platform (CEP), this brand transformed its approach to user retention, significantly increasing qualified leads, boosting loan application conversion rates, and ultimately driving a 36% surge in revenue.

Join us as we uncover the strategies and tactics behind this impressive performance, exploring the key elements that fueled the Fintech brand’s success and offer valuable lessons for any fintech business seeking to elevate its customer engagement and drive substantial revenue growth.

About the Brand

The Fintech app offers users a diverse range of financial products, including credit cards, loans, and insurance. Its single, unified interface allows for easy comparison of various products, making it a convenient solution for receiving personalized recommendations tailored to financial planning. The company has seen impressive growth, with a 62.5% increase in co-branded credit cards in force compared to the previous year. They now have a customer base of over 60Mn+ users.

Customer Success Story: Overcoming Customer Engagement Challenges in Fintech

1. Streamlining Customer Engagement Across Teams

Challenge:

The fintech company needed a unified platform to enable seamless collaboration across teams for campaign planning and execution. Without an integrated solution, different departments worked in silos, leading to inefficiencies and delays.

Solution:

Netcore’s Customer Data Platform (CDP) streamlined data consolidation by integrating online and offline sources, enabling a single-pane-of-glass view for all stakeholders. This ensured:

- Real-time collaboration across teams.

- Centralized insights for better decision-making.

- Faster campaign execution without operational roadblocks.

A visual representation of the Customer Engagement Platform’s (CEP) omni-channel capabilities.

2. Campaign Creation Guidance & Support

Challenge:

The fintech brand lacked running basic campaigns like web notifications and banners for loan and credit card promotions. They were unaware of strategies like Hyper-Personalized Loan Reminders or customer lifecycle campaigns to increase retention and lifetime value (LTV).

Solution:

Netcore Cloud’s Customer Engagement Platform along with hands-on support by the Customer Success Managers (CSMs) guided the brand on creating and executing advanced campaign strategies such as:

- Welcome Journeys to capture complete user details for better credit assessment.

- Behavioral Triggers like:

- Sending personalized loan reminders when a user’s credit eligibility improves.

- Engaging inactive users with exclusive loan offers based on browsing history.

Impact: These initiatives boosted user acquisition and increased app stickiness by 20%.

Measuring user acquisition by tracking app stickiness rate.

3. Improving Website Conversions: Loan Application Completion Rate

Challenge:

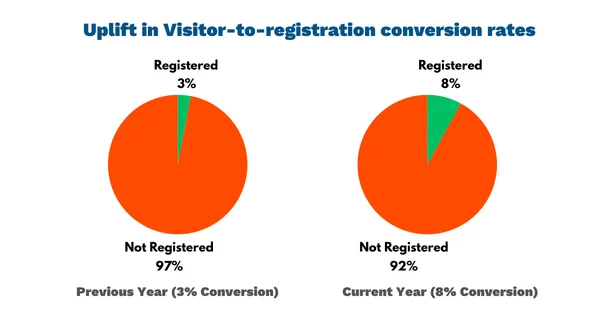

Despite high website traffic, the fintech company faced low conversion rates (below 3%) from users checking their credit options to completing a loan application. Traditional web push notifications weren’t engaging enough, leading to high drop-offs.

Solution:

The brand implemented Netcore Cloud’s Website Nudges, leading to:

- Upselling Credit Cards on Loan Pages – Prompting users to explore credit card options post-loan application.

- Rich Video Notifications – Guiding users through the loan application process, improving self-journey completion rates by 45%.

- Website Personalization – Dynamically fetching users’ names from their browser profiles to personalize CTAs, thereby grabbing user attention and increasing visitor-to-registration conversion rates to 8%. This resulted in approximately three times more loan applications than before, significantly boosting revenue.

Impact: Higher engagement and streamlined user journeys, driving more loan applications and lead conversions.

Measuring visitor-to-registration conversion rate.

4. Enhancing Cross-Selling Opportunities

Challenge:

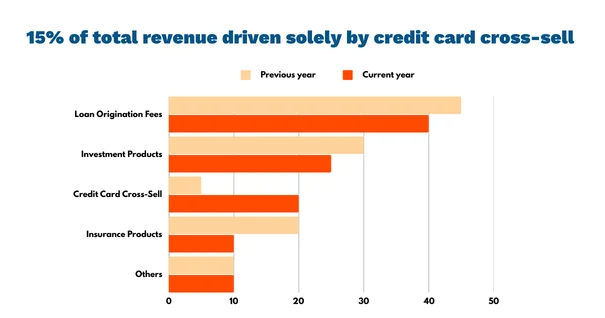

The fintech brand struggled with cross-selling credit cards to loan applicants. Their engagement strategy relied too heavily on email, missing out on real-time opportunities across multiple channels.

Solution:

Netcore Cloud’s omnichannel marketing approach leveraged data-driven personalization to drive better cross-sell outcomes:

- AMP Emails for Callbacks – Interactive emails allowing loan application completion directly within the inbox, increasing response rates.

- Website Personalized Nudges – Real-time engagement for users exploring financial products.

- Predictive Analytics – Identifying users likely to need a car or home loan based on transaction history and targeting them via:

- WhatsApp, SMS, and In-App Notifications for personalized upsell opportunities.

- Pre-approved Credit Card Offers via WhatsApp post-successful loan repayment.

Impact: Increased lead registrations and better cross-sell conversions across multiple financial products contributing to 15% of the overall revenue just through credit card sale.

Growth in Credit Card Cross-Sell Revenue (Fintech Brand)

5. Ensuring Data Accuracy for Personalized Engagement

Challenge:

The fintech company lacked complete user information beyond email IDs, making segmentation and personalization difficult. This led to generic campaigns and reduced engagement.

Solution:

The company used personalized nudges to encourage users to complete their profiles, improving data collection for more refined targeting. This enabled:

- Gamified Engagement: Reward-based App Push Notifications where users earned points for transactions, redeemable for:

- Reduced fees or cashback.

- Exclusive offers for inactive users (e.g., those who hadn’t transacted in 90+ days).

- Dormant User Re-engagement: Using remarketing ads and special incentives to reactivate churned users.

Impact: 4X increase in the app retention rates through improved user engagement strategies.

Measuring User Retention for a Fintech App

The Netcore Cloud Advantage

In India’s highly competitive financial services sector, where traditional banks, fintech firms, and NBFCs compete for dominance, this Fintech Brand successfully differentiated itself through personalization and superior customer experience—aided by Netcore Cloud’s Customer Engagement Platform (CEP).

Netcore Cloud played a pivotal role in driving 36% growth in FY24, empowering the brand with:

- Expert guidance from the Customer Success Manager (CSM) team, ensuring seamless campaign setup and execution.

- Data-driven engagement strategies, leading to higher open and engagement rates across push notifications and email.

- Targeted acquisition campaigns, boosting registrations through personalized CTAs, browser profile data, and GTM-driven engagement.

- Effective cross-sell and upsell initiatives, increasing credit card adoption via predictive analytics and omnichannel marketing.

By leveraging Netcore Cloud’s automation and insights, the fintech brand enhanced customer retention, streamlined operations, and expanded its market share. This strategic approach not only optimized user engagement but also established the brand as a formidable player in India’s fintech landscape. If you’re a fintech brand looking to overcome customer engagement challenges and drive growth, we’d love to help. Let’s connect and explore how Netcore Cloud can transform your marketing strategy! Contact Us.