Fintech and BFSI apps have become integral to modern financial habits—whether it’s digital banking, UPI payments, investing, or insurance. Yet, even the best apps struggle with a daunting challenge: user drop-off after the first few days.

Most marketers obsess over Day 0 to Day 7 metrics, but true product-market fit and profitability emerge beyond Day 30. This is when users either form a habit or fade into inactivity.

So, how do successful fintech marketers retain users beyond Day 30? Here are the retention tactics they swear by—and how Netcore empowers this journey from first install to lifelong engagement.

Understanding the Retention Cliff in Fintech Apps

Many apps may celebrate big acquisition numbers, but research shows a meagre 2.59% retention by Day 30 for Android and 4.13% for iOS. Fintech and BFSI apps often lose users due to a few critical reasons.

- Users don’t complete KYC or transact.

- Value isn’t delivered fast enough.

- Messaging isn’t relevant.

- There’s no reason to return after the first transaction.

- Complex UX or low trust perception.

Retention beyond Day 30 isn’t accidental—it’s engineered.

App Retention Tactics to Boost User Retention

To counter these drop-offs and build lasting engagement, here are strategic app retention tactics fintech marketers rely on to keep users active well beyond Day 30.

1. Hyper-Personalized Journeys Based on Behavioral Segments

One-size-fits-none in fintech.

Successful apps use behavioral triggers to identify segments & create hyper-personalized journeys. Features like affinity segments help identify segments based on behaviours like shared interests. For example:

- A user who explored loan options but didn’t apply gets a tailored journey with EMI calculators and approval probabilities.

- A new investor who browses mutual funds receives SIP 101 content and a demo call invite.

Netcore’s no-code journey builder lets you trigger multi-channel campaigns based on actions like profile creation, app abandonment, fund addition intent, and more.

2. Contextual Nudges that Drive Habit Formation

Day 30+ retention thrives on habit-forming design.

Think:

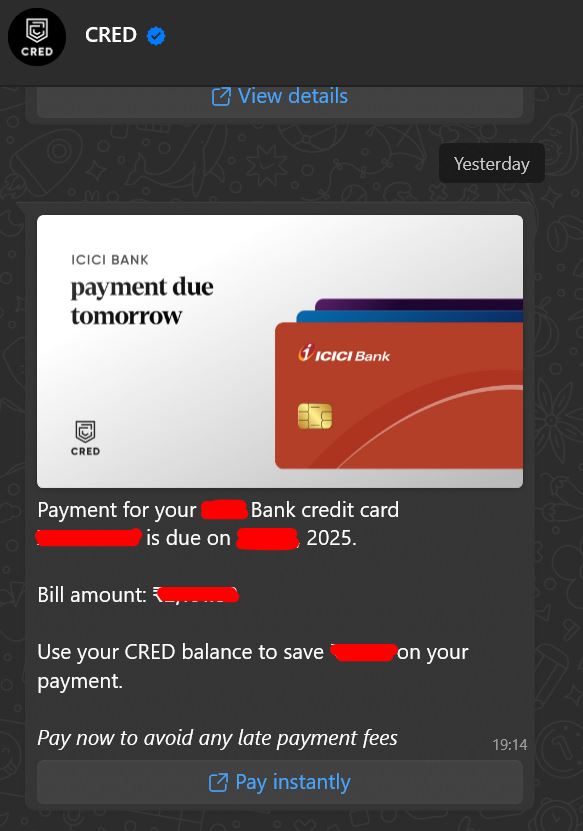

- Push notifications remind the user to pay their credit card bill just before the due date.

- WhatsApp messages reminding them to top up their wallet, complete their pending transaction, pay their monthly bills, etc.

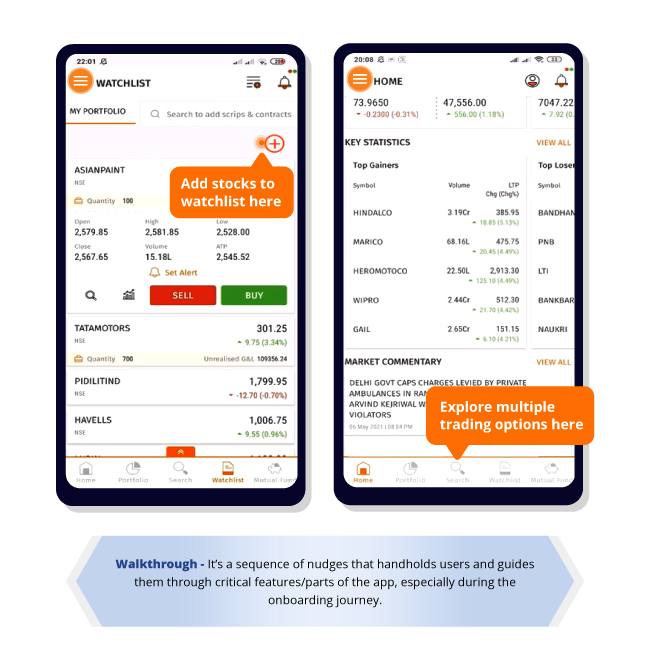

- In-app contextual nudges & walkthroughs, guiding users to take the next best action

These are not spammy—they’re contextually triggered nudges that reinforce financial habits.

Netcore Advantage: Deliver contextual, personalized and relevant messages via app push notifications, in-app, and WhatsApp messages at the right moment using behavioral analytics and AI-predicted schedules.

3. Gamification & Micro-Rewards Post First Transaction

Once a user transacts, how do you bring them back?

By making financial actions fun, rewarding, and trackable. Example:

- Give a badge when they invest consistently for 3 months.

- Reward small cashbacks for completing savings challenges.

This emotional reward loop builds stickiness.

Netcore Power Move: Trigger reward campaigns dynamically, based on activity streaks, not just generic user groups.

Navia leveraged Netcore’s In-App messages to introduce full-fledged, easily changeable games designed to impart financial knowledge while entertaining users. These games included:

- ‘Leaderboards’ to Foster cross-user interaction and competition.

- ‘Share Button’ Enabled users to share the game with friends to win Ncoins, boosting app downloads.

Learn the srategies Navia deployed with Netcore to increase app time sessions by 2x

4. Trust-Building Communication Cadence

Financial services are built on trust. Post-Day 30, this becomes more important than flashy UI.

Here’s what works:

- Educational drip campaigns on financial literacy.

- Weekly insights on how the user’s portfolio is performing.

- Regulatory updates decoded in simple language.

Netcore Feature Highlight: Use AMP emails, dynamic content blocks, and email+push orchestration to deliver trustworthy, timely insights.

5. Intelligent Win-Back Campaigns

Dormancy doesn’t mean lost.

Fintech marketers leverage Netcore to predict customer churn and dormant users.

With the help of RFM analysis, you can identify dormant users and create reactivation journeys tailored to these dormant users to bring them back via:

- Personalized email reminding the user of unclaimed cashback.

- WhatsApp reminder of benefits they haven’t unlocked.

- A dynamic landing page showing how they compare to active users.

Netcore Capability: AI-powered churn prediction + dynamic audience segmenting & targeting = frictionless win-back at scale.

How Netcore Helps Improve First Transaction Rates and Day 30+ Retention

Here’s how Netcore directly improves retention and first transaction success:

| Challenge | Netcore Solution |

| Low onboarding completion | Omnichannel journeys to nudge incomplete users (push notifications, AMP email, WhatsApp, RCS). |

| First transaction delay | Contextual nudges + personalized offers to drive Day 0–Day 7 conversions. |

| Drop-off before Day 30 | Habit-forming micro-journeys with personalization, no-code in-app nudges. |

| Trust deficit in communication | AMP emails + educational journeys + AI-recommended content. |

| Inactive users | Predictive churn detection + AI-led reactivation campaigns. |

Conclusion

Retention is no longer a luxury—it’s your competitive moat. Fintech and BFSI apps that win beyond Day 30 combine behavior science, automation, personalization, and trust.

With Netcore, you don’t just nudge, you nurture. You don’t just convert—you retain. Ready to go beyond Day 30?

Let’s talk retention. Contact us to build your fintech retention engine.

Worried About Your AI Marketing Strategy? Read the Agentic Marketing 2026 Predictions Report! →

Worried About Your AI Marketing Strategy? Read the Agentic Marketing 2026 Predictions Report! →