1. AdWaste to Profipoly

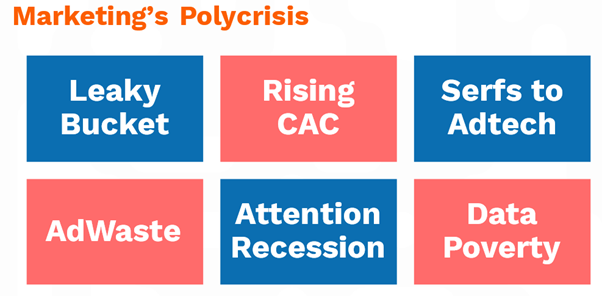

$200 billion a year, growing at 25-30%. That’s the AdWaste that eats away at brand profits. Caused by completely avoidable wrong acquisition and reacquisition, AdWaste is the biggest of many profit-killers. Big Adtech (henceforth called Badtech) is the primary beneficiary of this largesse. This ‘handout’ has also shifted the marketing industry’s balance of power away from brands and agencies to the likes of Google and Meta. The massive reduction in profits has been caused by an escalating new customer acquisition race which wastes half of budgets has created a polycrisis in marketing: a leaky bucket of customer additions which take up 85-90% of spending and whose lifetime value cannot be fully extracted because they churn and thus force marketers to reacquire them or acquire other new ones via even more adtech spending. Attention recession and data poverty hurt the marketer’s ability to build hotlines and deliver omnichannel personalisation. In other words, marketers are facing the perfect storm: in a slowing market, revenues and profits are being hurt even more because of their inability to escape Badtech’s web.

The time has come for a mindset shift from acquisition-centric marketing to profit-centric marketing; this is a journey every business will need to make because it is the only way to build an enduring, great business. The easy money era of the past years is behind us and will not be coming back anytime soon. Badtech benefited greatly from money transfers from pension funds (via VCs and Pes through new age startups); in the years just gone by, a third to half of capital raised by B2C companies was spent on the likes of Google and Meta. Fuelled by a FOMO (fear of missing out) in the battle for the next new customer, brands and marketers ceded their sovereignty and lost sight of a business’s soul which is to ensure existing customers come back for more and bring along their family and friends. We as consumers lost our privacy and the warmth of brand relationships. We became data points in CDPs (customer data platforms), not distinct individuals in search of brand love and frictionless experiences.

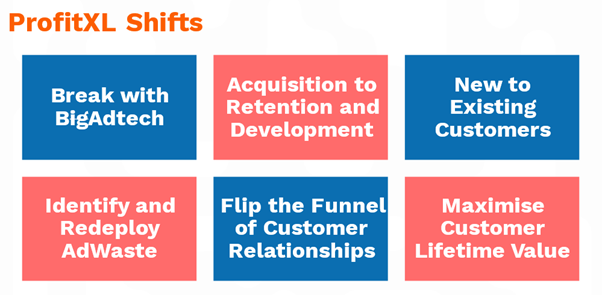

Luckily, help is at hand. A set of innovations and well-planned actions can end AdWaste and supersize brand profits: a 25% shift of budgets away from Badtech can deliver more than a 50% increase in profits, while a 50% shift can more than double profits. This is what I call ProfitXL: a strategy to supersize (eXtra Large as denoted by XL) profits by breaking with badtech, a flipping of the funnel of brand-customer relationships to solve marketing’s polycrisis.

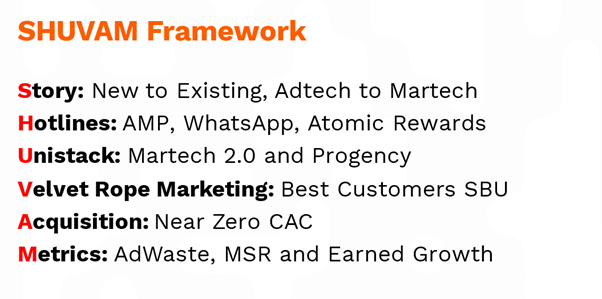

ProfitXL is built around five themes which I have covered extensively over the past three years on my blog: the need for one-way push channels to become two-way conversational pathways thus bridging the chasm between acquisition and conversion, the transition from point solutions on the brand’s properties (website and app) to a unified martech stack, the identification of Best customers and creating differentiated experiences for them, getting close to zero CAC (customer acquisition cost) for new customers, and measuring growth based not on paid marketing spends but on repeat purchases from existing customers and revenues from referrals. This is ProfitXL’s SHUVAM framework: Story, Hotlines, Unistack, Velvet Rope Marketing (VRM), Acquisition (done right), and a new set of Metrics to measure progress. SHUVAM is the path for exponential forever profitable growth. If followed rigorously, it can help a brand create the ultimate endgame and moat in a business – a profits monopoly (“profipoly”).

The ProfitXL mindset and SHUVAM strategy will help marketer’s increase revenues, reduce spends and improve shopper experiences. After almost two decades of digging the AdWaste hole, marketers can climb the profits mountain and aspire to reach the profipoly pinnacle.

2. Story

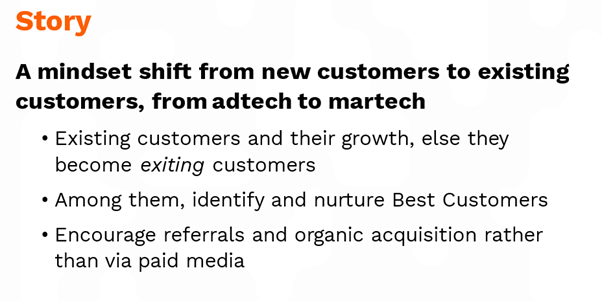

The journey to ProfitXL begins with an understanding of marketing’s polycrisis and a marketer’s determination to shift the mindset from adtech to martech, and from new customers to existing customers. Part of the problem for marketers is self-inflicted because they ignore existing customers; then even among existing customers, they do not create differentiated experiences for Best customers; and then when it comes to new acquisition, they disregard the power of referrals, reactivation, and smarter acquisitions based on data from existing customers. Little surprise then that more and more money keeps getting poured into the new customer funnel which in turn leads existing customers to become exiting customers.

The three slides below lay out the story that marketers need to understand to embark on the ProfitXL journey.

3. Hotlines

Marketers spend money acquiring customers, and then hope to monetise them on their properties (website and app). This is easier said than done because unless marketers are able to imprint their brand on the consumers subconscious, they face a continuous battle to bring them back for transactions. This is done through a process called engagement: messages pushed to our already flooded inboxes, along with nudges and recommendations when consumers clickthrough. The problem is that as consumers we are numb to all these exhortations and ignore the incoming offers. This “attention recession” has serious consequences for marketers – because if we don’t open and act on their emails, SMSes, and push notifications, they have little choice but to retarget us on the Badtech auction platforms spending even more money to reactivate their relationship with us.

For the past decade or so, almost nothing has changed in the push channels. And now, almost suddenly, a triad of innovations is creating excitement: emails can become interactive thanks to a technology called AMP, WhatsApp (popular in many countries) has allowed for brands to interact with customers, and Atomic Rewards can offer gamified micro-incentives to encourage attention and the sharing of personal information (also called zero-party data). AMP, WhatsApp and Atomic Rewards can thus drive inbox engagement and action funnels closer to consumers. AMP and WhatsApp can even replace apps – and combined with the advantage of ‘push’ give marketers control to initiate conversations which can lead to conversions.

AMP, because of its underlying email base, costs a fraction of that of WhatsApp (which is controlled by Meta). While still in its infancy in terms of use cases being deployed, AMP will enable what I call “All-in-Mails”. From filling forms to lead generation, from spinning wheels for offers to using calculators for answers, from getting additional product information to acting on abandoned shopping carts, from searching to paying – AMP is the future of email. Think of it as Email 2.0 – email without the need for clickthroughs and landing pages, a world without redirects.

Atomic Rewards is the icing on the cake. Instead of paying Badtech, brands can pay their customers. This is Loyalty 2.0, moving beyond the transaction to incentivising and gamifying the upstream (attention and data) and the downstream (ratings, reviews and referrals). This manifestation as Web3 tokens will ensure no single entity will be able to devalue the points earned. Atomic Rewards can drive a circular economy between brands and customers: more actions lead to more tokens for customers, which in turn makes brands value them even more. These rewards can then be exchanged for unique experiences or fiat currency.

AMP in email, WhatsApp and Atomic Rewards convert the unidirectional push channels into two-way rich interactive hotlines, thus finally enabling marketers to bridge the chasm between new customer acquisition and attracting traffic to their properties. Hotlines are thus the gateways to building deep and lasting relationships, a win-win for both brands and customers.

4. Unistack

Over the past few years, marketers have combined multiple point solutions to create their martech stack to collect data from websites and apps, automate customers, segment customers, and run push and personalisation cross-channel campaigns. The problem? The fragmentation of data caused by the use of multiple solutions and the inherent difficulties in integrating software from different vendors. While CDPs and APIs have tried to alleviate the problem to some extent, marketers are still unable to get a single unified view of their customers. Also, siloed databases limit the efficacy of AI-ML systems to push the next best actions. So, while the first-generation of martech solutions brought in much-needed digital aggregation and automation, it also created new headaches for marketers.

It is time for marketers to upgrade the martech stack with second-generation all-in-one solutions. This “Unistack” which combines customer data, engagement and experience management with complete channel control will enable marketers to dramatically improve the efficiency of their customer relationships and take big steps towards the nirvana of frictionless omnichannel personalisation.

The second big improvement in outcomes will come from improving the search experience for shoppers. Most marketers tend to use the default search software which comes with their ecommerce platform or pick up an open-source utility to keep the spend low. This is a big mistake. Search has been the most powerful application on the Internet. On websites, customers have been trained to use search as a last resort option because the results lack relevance; a product may be in the catalog but between the inability of the merchandising team to describe it right and the imprecision in using words to type in the search bar, the product is never shown and thus doesn’t get sold. A powerful site search engine can do wonders for revenue growth. AI engines can widen product descriptions beyond what humans can, and match products to a consumer’s intent ensuring a happier shopping experience.

The third solution lies in the creation of a “Progency” – a new-gen martech services entity where product (unistack) meets agency. A progency can work like a performance marketing entity taking on KPIs and delivering the outcomes marketers want. For this, a progency will need to combine software and analytical skills with traditional creative skills, uniting left-brain and right-brain resources. It can work as an extension of the marketing department taking on specific tasks with success-linked compensation.

The Unistack embedded with quality search and propelled by the progency is the second success pillar after Hotlines, delivering the personalisation that customers want to fast-track purchases of products they desire.

5. Velvet Rope Marketing

VRM is at the centre of SHUVAM and one of the most important drivers for ProfitXL. It can be called by various names – customer-centricity in Wharton professor Peter Fader’s books, red carpet marketing as some have termed it, or simply loyalty marketing. The big idea behind VRM: that a small fraction of customers account for an outsized chunk of revenues and more than 100% of profits. (The latter happens because the long tail is lossy thanks to acquisition and servicing costs.) And yet, most marketers treat all customers the same. We have all been at the receiving end of such undifferentiated ‘equalising’ experiences! Little wonder then that brand loyalty appears a thing of the past – which in turn pushes marketers back into the embrace of Badtech in the eternal quest for more revenues.

An effective VRM program needs three elements: a customer-base audit to better understand buying behaviour of existing customers with a systematic review of transactions, the twin combo of customer lifetime value (CLV) and Best Customer Genome (BCG) to identify the most valuable customers and their characteristics, and the creation of a separate business unit to provide differentiated experiences for the Best customers.

A customer-base audit helps marketers understand how customers differ in their buying behavior and how their buying behaviour evolves over time. As Peter Fader, Bruce G.S. Hardie and Michael Ross explain: “The starting point is a list of transactions for each customer (date, time, products purchased, total spend, etc.)…Traditional reports will summarize performance by product. Think of an Excel worksheet where the rows correspond to individual products and the columns correspond to time (e.g., quarter). Now, imagine an alternative summary table — again, think of an Excel worksheet — where the rows now correspond to individual customers and the columns correspond to time (e.g., quarter). The entries in the table report each customer’s total spend with the firm in that particular time period. Another table tells us how many transactions each customer made with the firm. (For most firms, these tables will contain lots of zeros.) If you’re lucky, you’ll also have an equivalent table that summarizes the profit associated with each customer in each period.”

The next step is to calculate forward-looking CLV based on data from the audit. This will help in segmenting customers into Best, Rest and Test. The 20% Best customers are the most valuable, while the Test customers are least important. And in the middle are the Rest, who could go into either one of the other segments based on their experiences with the brand. Once the Best customers are identified, the next step is to understand what’s common to them and their buying behaviour (customer journey) – this is the BCG.

Armed with a knowledge of the Best customers at an individual level, marketers need to craft unique experiences for them to ensure they achieve their CLV threshold. An XRT (eXtreme Retention Token) can help identify Best customers when they enter an offline store. Exclusivity, ease and access are three dimensions for enthralling such customers – like airlines do for their first- and business-class customers. An SBU for Best customers is what marketers need to create to ensure that their Best customers are treated like royalty, rather than numbers in a loyalty program.

A good VRM program will go a long way in ensuring consistent revenue growth. Best customers, nurtured through differentiated experiences, can also help get others like them from their network. That’s the next step in the ProfitXL journey.

6. Acquisition

Acquisition of new customers remains the primary focus of most marketers today – at the cost of enhancing relationships and revenues from existing customers. With hotlines, unistack and VRM, marketers can flip the funnel – putting existing customers at the top. New customer acquisition will remain an important growth driver, but it needs to be done differently by making “near zero CAC” as the objective. There are three ways to sharply reduce CAC: referrals, reactivation, and BCG-influenced acquisition.

Referrals are where existing customers bring in new customers – based on word-of-mouth or via social networks. Marketers have to pay very little for such acquisition – hence the CAC is close to zero. If the referrals come from Best customers, it is even better – because Best are likely to beget Best. A simple technique that marketers can use is to add a field to the sign-up form on who the referrer was for a new customer, and give a micro incentive to both. A good referral program augmented with authentic ratings and reviews can go a long way in increasing profitability.

Reactivation is another strategy to reduce CAC – because the alternative could end up being expensive reacquisition! Existing customers (especially the Test ones) end up becoming dormant for a variety of reasons: they did not find what they were looking for, their interests changed, or the brand communications were not engaging enough. Some in the inactive category could also have churned away to a different brand. The key to note is that there was a relationship once – which means the brand has some identity information (mobile number, email address) to reopen a conversation. Informative content which is helpful and not pushy can be a good way to ‘awaken’ the inactive base. AMP and Atomic Rewards can be useful aids for reactivation.

The third low-cost acquisition strategy is to use data about Best customers to target look-alikes. Most brands tend to either use the data of all customers which just leads to a lot of wrong customers being acquired who bounce from the website or uninstall the app shortly after installing it. Attributes and commonalities among Best customers can help sharpen targeting of new customers. Also, profiling tools could help identify the likelihood of the person being a future Best customer from the pool of Next customers. If that is the case, then marketers can ensure a superior experience in the early days to increase the chance of a longer and mutually beneficial relationship.

Once the revenue engine from existing customers starts flowing and growing, there is much less pressure on marketers to deliver on growth targets. They can thus be more judicious with the spending on new acquisition, especially with CAC rising 40-50% year-on-year. Reducing the ad spends (with concomitant AdWaste) and redirecting some of it to existing customers is the way marketers can grow the profits and play their part as Chief Profitability Officers.

7. Metrics

The fifth and final step in the ProfitXL journey is measurement. While profits are the ultimate metric, there are many components which are not in the marketer’s control. What they can do is to focus on three numbers: AdWaste, Martech Spend Ratio (MSR) and Earned Growth.

AdWaste can actually be measured. It comprises wrong acquisition and reacquisition. Marketers need to dig into their databases and see what percentage of acquired customers are still active after a specified period of time (say, three months). The rest, especially those who left without making a purchase, can be construed as wrong acquisitions. Reacquisition can be identified by checking if a newly acquired customer was a previous customer by checking the identifiers. Getting a handle on AdWaste is important because this is the budget that can be made available for the ProfitXL program.

MSR is the percentage of marketing spend on martech (existing customers) from the overall budget. In most brands, the MSR is about 10-15%, meaning that 85-90% of the budget is being spent on (B)adtech for new customer acquisition. The goal for marketers should be to shift the budget from adtech to martech, and get MSR to greater than 50. This is a huge pivot – from making new customers as the growth engine to leveraging the power and potential of

Marketing Today: facing a leaky customers bucket; serfs to Big Adtech; struggling for profits

- New customers, performance-linked (unlimited) budgets, rising CAC

- Reduced or no profits means business future determined by investors / competitors

- Objective: control own destiny; customers for life; exponential forever profitable growth

Polycrisis Problem: AdWaste and other Profit-Killers create Profit-less Growth

- Spending on Adtech is 85-90% of brand marketing budgets; Wrong Turn

- Adwaste is 50%: wrong acquisition and reacquisition; Adtech à Big Adtech à Badtech

- Profit-Killers: Adwaste, attention recession, data poverty, and more

ProfitXL Solution: shifting from acquisition-centric marketing to profit-centric marketing

- Break with Badtech

- Growth at all costs to profitable, sustainable growth

- Flip the Funnel of Brand-Customer Relationships to solve Marketing’s Polycrisis

Story: a mindset shift from new customers to existing customers, from adtech to martech

- Existing customers and their growth, else they become exiting customers

- Among them, identify and nurture Best Customers

- Encourage referrals and organic acquisition rather than via paid media

Hotlines: to solve Attention Recession and Data Poverty in push channels

- AMP; Interactive emails (Email 2.0) to convert conversations into conversions and commerce

- WhatsApp: a second channel for interactivity; the new SMS

- Atomic Rewards: micro-incentives via Web3 tokens; Pay customers, not Badtech

Unistack: to drive Frictionless Omnichannel Personalisation

- Martech 2.0 stack: unified customer view backed by a CDP

- Site Search: AI-powered search and recommendations

- Progency: product meets agency for performance-based, KPI-driven martech services

Velvet Rope Marketing: to create differentiated experiences for Best Customers

- Customer-Base Audit: to analyse buying behaviour based on transactions data

- Customer Lifetime Value to segment into Best-Rest-Test; Best Customer Genome (BCG)

- SBU for Best customers; eXtreme Retention Tokens; experiences with exclusivity, ease, access

Acquisition: restructured for near Zero CAC

- Referrals, augmented by ratings and reviews

- Reactivation: alternative to expensive reacquisition; use AMP and Atomic Rewards

- BCG-influenced acquisition; along with early identification of future Best from Next

Metrics: to Measure the Right Progress

- AdWaste: the pool of money that’s available for redeployment

- MSR: Martech Spend Ratio; percentage of budget on existing customers; get to 50+

- Earned Growth: from existing customer growth and additions via referrals; get to 50+

Endgame: Build a foundation for ProfitXL

- Profitable Growth: not just growth at all costs

- Exponential and Forever: maximising lifetime revenues

- Profipoly – Profits Monopoly – as the ultimate moat