Walk into a branch. Open your mobile app. Call the support line. Scroll through WhatsApp alerts. For customers, these aren’t separate interactions—they’re all “banking.” And if the experience feels disjointed, trust erodes fast.

That’s the challenge: most banks have channels, but very few have omnichannel banking. The difference is subtle but critical. Multichannel means availability; omnichannel means consistency. It’s the difference between repeating your account number three times to three different agents… and feeling like your bank actually knows who you are.

In 2025, that difference will decide who wins. Customers already benchmark their banks against Amazon and Flipkart, not other banks. They expect personalization, speed, and continuity across every touchpoint—branch, ATM, app, call center, email, or chat.

This article explores what omnichannel banking really means, why it matters now more than ever, the benefits it brings, and the practical steps (and tools) banks can use to make it real.

TL;DR

Omnichannel banking isn’t more channels—it’s connected experiences across them (vs. siloed multichannel).

In 2025, customers expect seamless, personalized journeys from banks—just like ecommerce.

Benefits: higher satisfaction, stronger revenue, lower churn, compliance-ready engagement, better efficiency.

Use cases: onboarding, loan cross-sell, real-time fraud alerts, festive campaigns.

What’s next: AI-led personalization, conversational banking, and faster, compliance-first execution.

What Is Omnichannel Banking?

Omnichannel banking means providing a consistent, seamless banking experience across every touchpoint—branch, app, ATM, call center, email, WhatsApp, or web—so the customer feels like they’re interacting with one bank, not a fragmented set of systems.

Elaboration:

- Multichannel banking = offering many channels (mobile app, branch, ATM, call center) but each is siloed.

- Omnichannel banking = stitching those channels together so a customer journey flows naturally. Example: applying for a loan online, getting instant WhatsApp updates, and finishing the paperwork in-branch—without repeating information.

This consistency is what builds trust. And in financial services, trust is everything.

Why Omnichannel Matters for BFSI in 2025

Customers now compare their bank’s digital experience not with other banks, but with Amazon, Flipkart, and Uber. If banks don’t step up, fintech disruptors will.

The big drivers:

- Consumer expectations shaped by ecommerce: Personalized offers, instant responses, seamless transitions.

- Digital-first habits: A majority of banking interactions now begin on mobile.

- Compliance & trust: Engagement must stay secure and aligned with GDPR, PCI, DMARC.

- Fintech competition: Neobanks and super-apps are raising the bar.

Benefits of Omnichannel Banking

Omnichannel helps banks increase satisfaction, grow revenue, reduce churn, and remain compliant—all at once.

Breakdown:

- Increased Revenue & Cross-Sell

- AI personalization helps target the right users with the right product (loans, cards, wealth).

- Example: Identifying a young professional likely to need a credit card and surfacing the right offer across email + app.

- Reduced Churn

- Real-time alerts and retention journeys prevent drop-offs.

- AI segments identify “at-risk” customers.

- Compliance & Security

- Omnichannel tools ensure engagement is consent-based and secure.

- Features like DMARC enforcement protect email reputation.

- Operational Efficiency

- Centralized orchestration reduces campaign duplication.

- One system = less cost-to-serve.

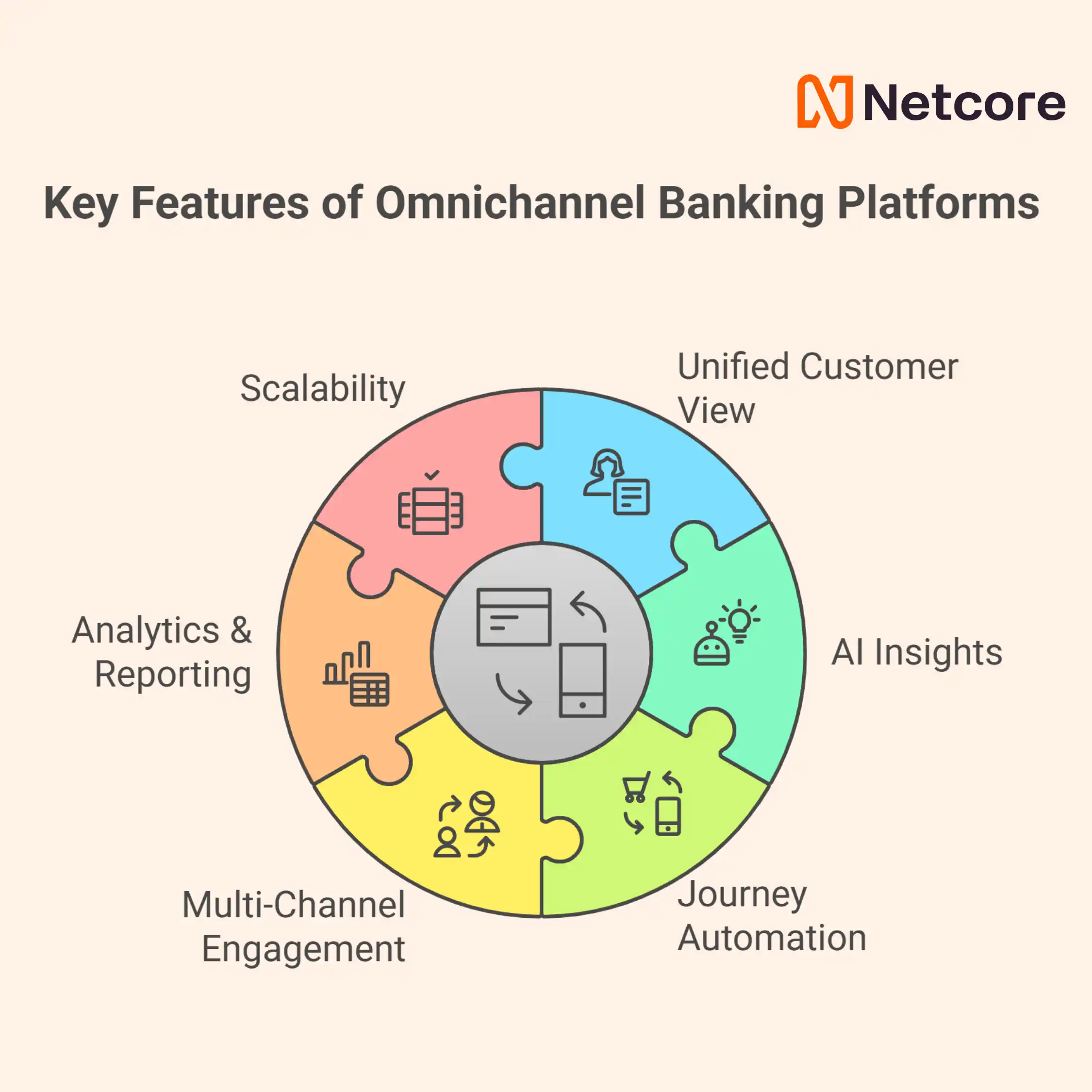

Must-Have Features in Omnichannel Banking Platforms

To succeed, a platform must unify data, personalize at scale, and stay compliant. Here are some must-have features in a platform for omnichannel banking:

- Unified Customer View: A 360° profile across branch + digital channels.

- AI Insights: Predict churn, recommend next-best product, optimize send-times.

- Journey Automation: Seamless transitions across channels (loan journey that begins on app, finishes on WhatsApp, confirmed via email).

- Multi-Channel Engagement: Email, SMS, WhatsApp, push, in-app, call center, ATM kiosks.

- Analytics & Reporting: Funnel drop-offs, campaign attribution, compliance reports.

- Scalability: Handle millions of customers, multi-language support.

This is where Netcore shines: with Agentic AI, Insight Agent, and Segment Agent, banks can predict churn, personalize offers, and orchestrate journeys across WhatsApp, SMS, email, and push—while ensuring compliance.

Top Use Cases of Omnichannel Banking

Omnichannel isn’t abstract—it’s practical. Here’s what banks can do.

1. Personalized Onboarding Journeys

- Welcome new customers across email + WhatsApp.

- Netcore automates this with Segment Agent, ensuring tailored onboarding for first-time users.

2. Loan & Credit Card Cross-Selling

- Use affinity models to predict which customers are most likely to convert.

- Deliver personalized recommendations across app + SMS.

3. Fraud Alerts & Notifications

- Real-time alerts via push/WhatsApp.

- Netcore’s Insight Agent ensures these are sent instantly, reducing risk.

4. Retention Campaigns

- Identify “at-risk” customers using RFM and cohort analysis.

- Trigger targeted offers via preferred channels.

5. Festive Campaigns

- Banks often run offers during Diwali, Navratri, Ramadan.

Netcore’s Content Agent lets teams publish festive campaigns across all channels with a single click.

Discover how Equitas Bank used Netcore to boost app adoption

Expert Insights: The Future of Omnichannel Banking

I asked a few BFSI product leaders what they see coming next. The consensus? AI will be the game-changer.

- “Segment of one” personalization: No more mass offers—AI will personalize down to the individual level.

- Hyper-compliance: Regulations will tighten, so platforms must bake in GDPR/DMARC/KYC by default.

- Conversational banking: WhatsApp, chatbots, and voice AI will become mainstream channels.

Faster execution cycles: Campaigns that once took 4 weeks will need to launch in hours.

“Speed without compliance is reckless. Compliance without speed is useless. We need both.”

– CMO of leading a bank

How to Choose the Right Omnichannel Banking Solution

Don’t just pick the biggest vendor. Match the platform to your bank’s maturity stage.

- Traditional Banks: Need robust compliance + integration with legacy systems.

- Digital-First Banks: Prioritize AI personalization + mobile-first orchestration.

- Enterprises: Must handle millions of customers, multi-language, regulatory complexity.

Key considerations:

- Scalability.

- Compliance certifications.

- AI-readiness.

- Vendor support.

And remember: software is only half the equation. Banks need vendors who co-own KPIs—something Netcore delivers through its managed consulting model.

Final Take

Omnichannel banking isn’t optional—it’s how banks in 2025 will build trust, drive product adoption, and stay competitive with fintech disruptors. Customers expect personalization, speed, and consistency across every touchpoint.

Netcore offers AI-led personalization, omnichannel orchestration, compliance-first design, and KPI-backed consulting—making it the most practical choice for banks looking to deliver seamless experiences at scale.

Worried About Your AI Marketing Strategy? Read the Agentic Marketing 2026 Predictions Report! →

Worried About Your AI Marketing Strategy? Read the Agentic Marketing 2026 Predictions Report! →