The pandemics and crises in the past have shown that the insurance sector has been more than prepared to take the brunt. But then COVID-19 isn’t like any other crisis. The Global slowdown is inevitable and with the world GDP dropping, every bulletin is not showing signs of a quick recovery.

But the show must go on, so does engagement between your brand and your customer. Here are a few ways the biggest brands in the Insurance industry are engaging with their customer during the crisis.

Business As Usual?

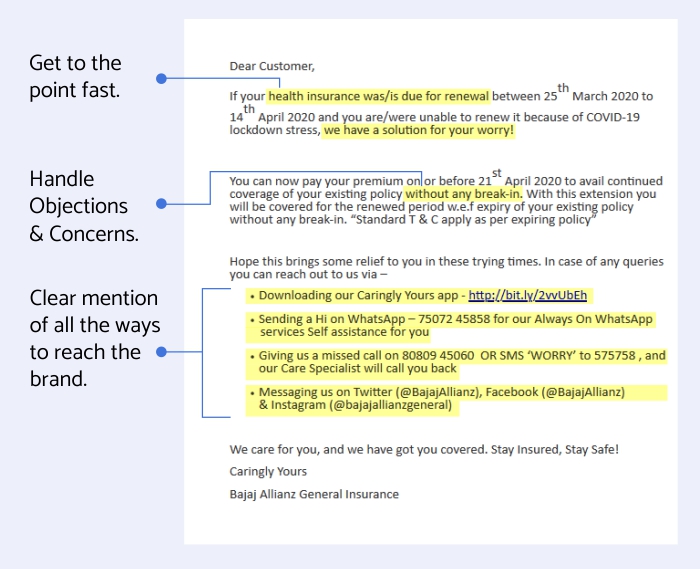

What happens if I have a claim in such times? What if my insurance renewal is due? What if I want to buy a new policy?

So many what-ifs. The COVID19 crisis made us question everything. That includes the operative ability of critical businesses. The brands in the insurance sector had to combat these uncertainties rising in the customers’ minds on time.

And they did it well.

We Care for You

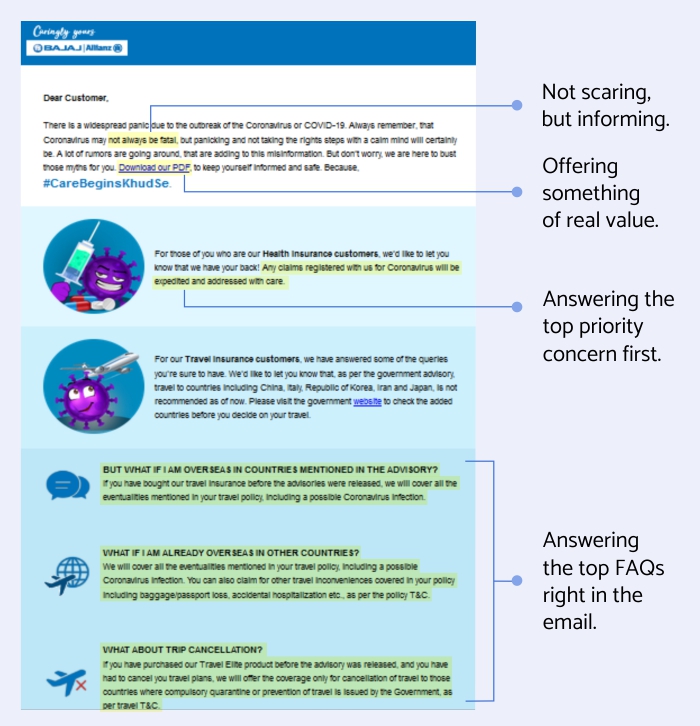

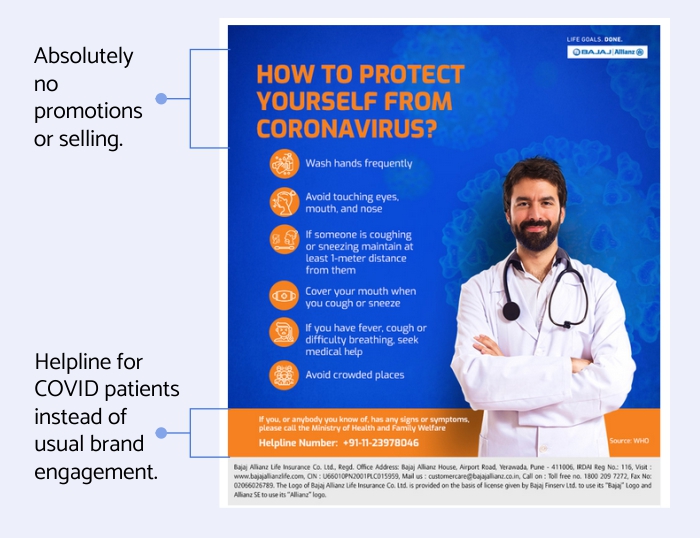

As COVID-19 came knocking the whole country went into a sudden lockdown. No one was prepared for it. No one could have. Neither the brands nor the customers. In moments like these, all you need is empathy and care. And that’s what the brands did right.

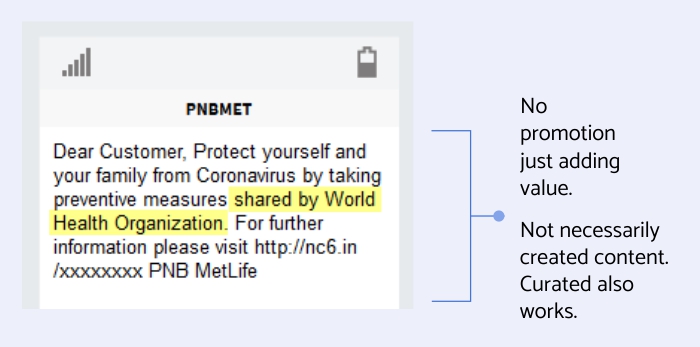

There’s a catch with the insurance business – no one wants to be in a situation where they have to use insurance. But then a pandemic is exactly one of those times. And the brands didn’t disappoint. They used all the channels at disposal including emails, SMS, social media, push notifications, and more to spread the right information and to guide customers in the right direction.

Here’s how the brands did it right:

We’re Here for You

With the rising uncertainty about almost everything, the customers needed to know that they can still rely on the brands they have trusted for exactly times like these. Brands responded by communicating the availability information of their staff at select branches.

SMS – the underdog of all communication channels came to rescue. We saw brands choosing texts to be the most reliable channel for this vital communication.

When the Work From Home became mandatory for almost everyone around the country, the brands ensured uninterrupted support with the help of Chatbots on top of conventional support systems.

Digital is Default

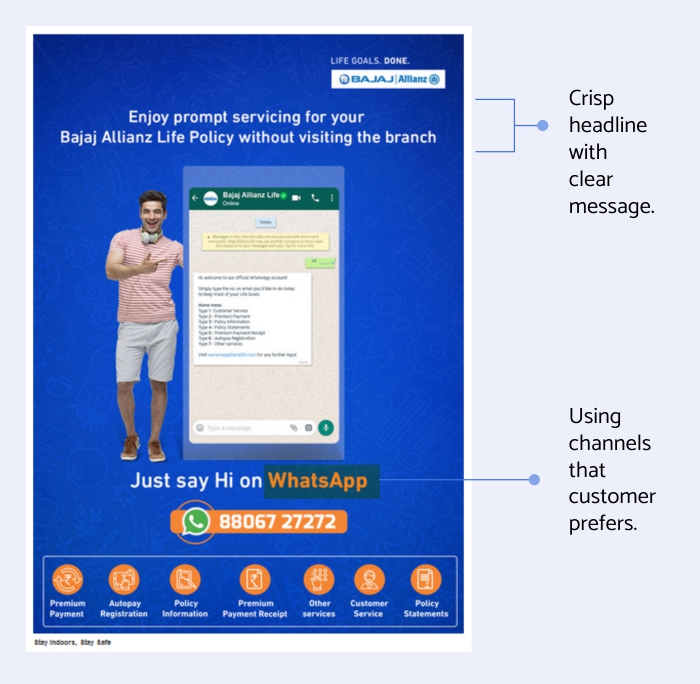

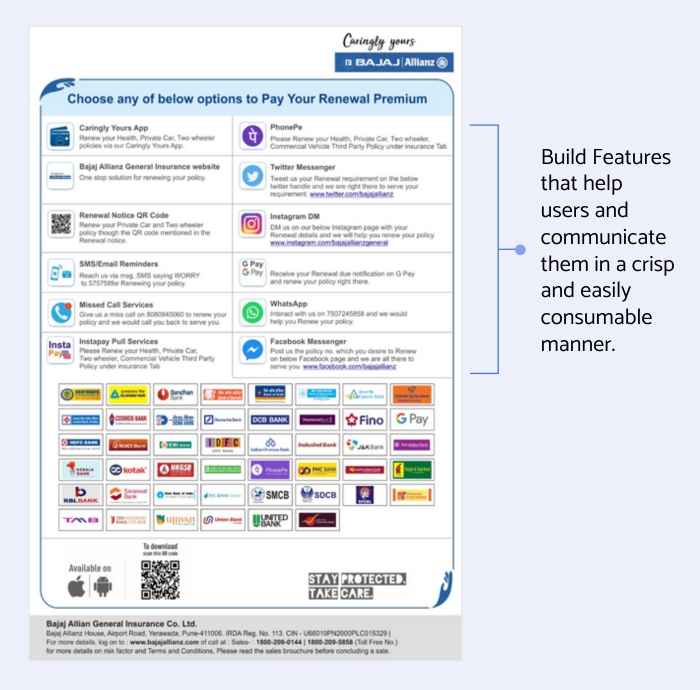

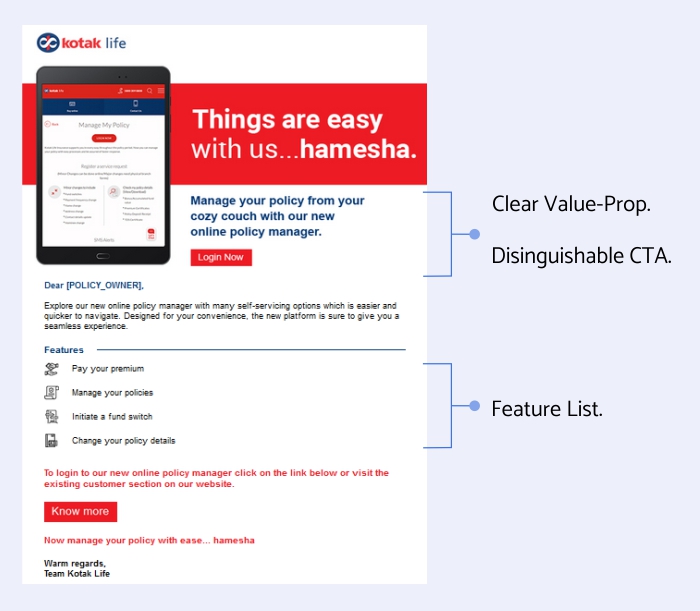

With physical contact becoming highly risky, the importance of going digital became indispensable. All the preparation and investments that the brands have been making in their digital transformation efforts paid off big time.

We saw brands being creative about communicating this and we absolutely loved all of it. Here are a few that demand a mention.

Get Busy Living

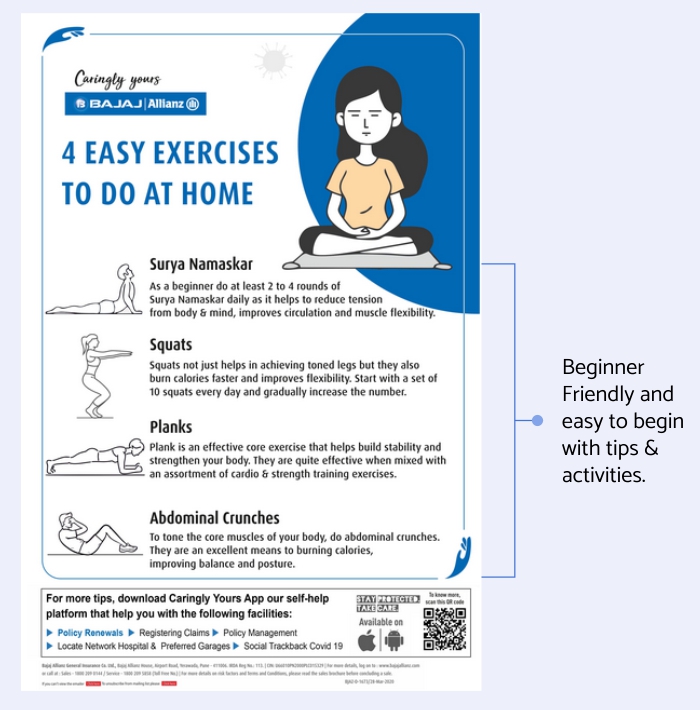

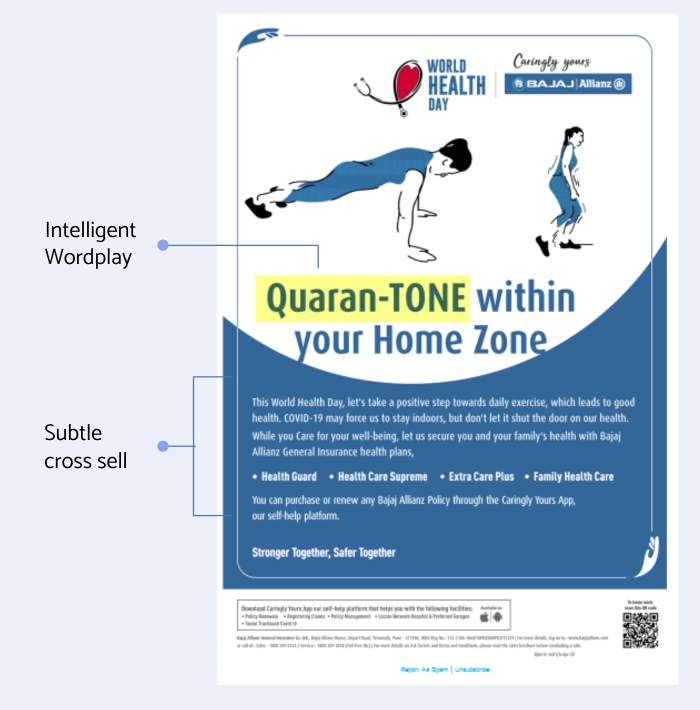

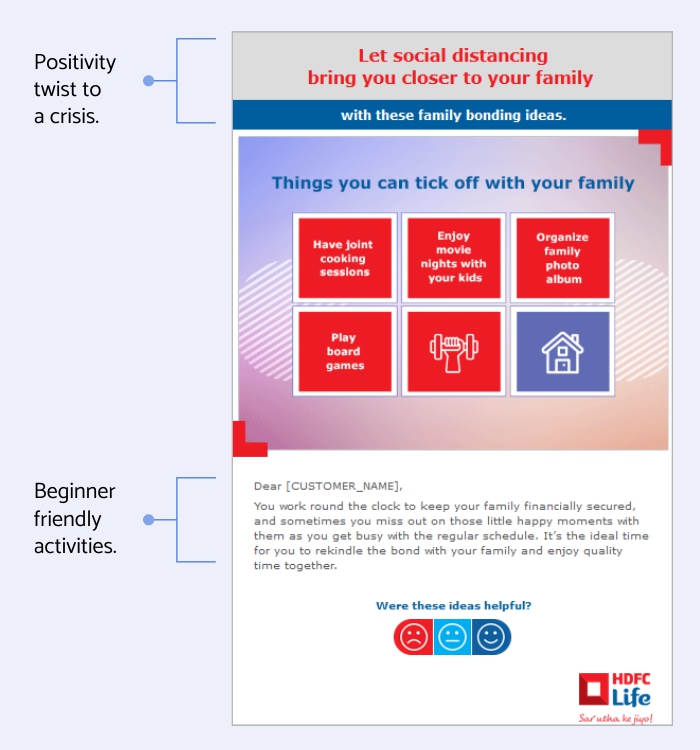

The lockdown came with its own set of perks – a lot of family time. People finally had more time on their hands than they can spend. Brands took this as a chance to engage with them in a non-transactional way.

The notifications went buzzing with home exercises, mindfulness tips, kitchen hacks and so much more.

Content is King. Engagement is Noble.

“People will forget what you said, people will forget what you did, but people will never forget how you made them feel.” – Maya Angelou.

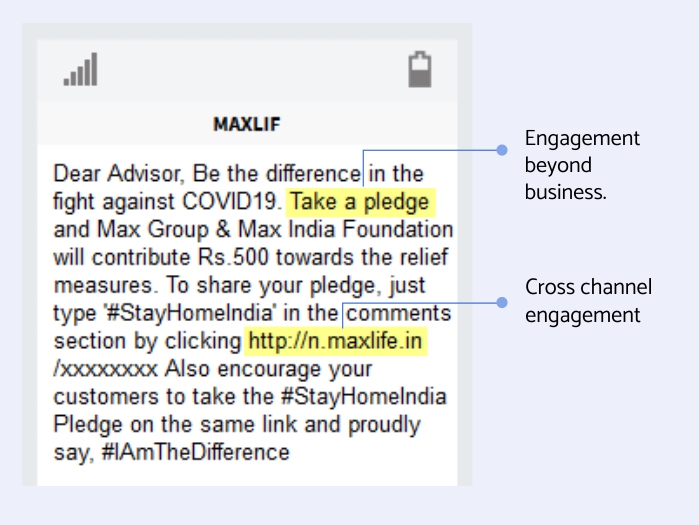

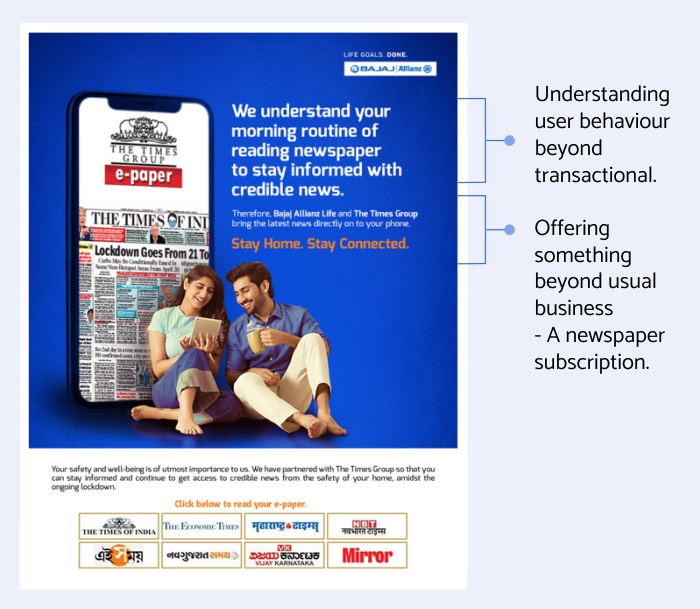

With the transactional communication reduced to a bare minimum, the brands had two options – be silent or be innovative. The majority chose the latter. They started engaging with their customer base with creative ideas and offers.

From free e-newspaper subscriptions to virtual fitness sessions, brands went up and beyond to be relevant and engaging. A lot to learn here.

What More?

Watching the biggest of brands executing top-notch engagement campaigns inspired us to dorn our own thinking caps. Here’s our inspired list of a few more campaigns that you can add to your COVID-19 marketing playbook:

Rise of the Bots

WhatsApp as a channel just opened up for business and brands are killing it with customer engagements at an unimaginable scale. We did something really cool that involved Big B, Big Billion Days, Flipkart, and WhatsApp.

However, those were Pre-COVID days. So what now? Especially for the insurance sector?

WhatsApp bots can be your foot soldiers to automate document collection, e-dispatch of policy, payment collection, and all other transactional customer communication and interactions.

#GetPersonal with Your Customers

Social distancing mixed with lockdown has restricted the human advantage that business leverage. How to ensure personalized experiences for each one of your customers?

Personalization.

Work on delivering an omnichannel hyper-personalized experience for experiences based on understanding their micro-engagements.

Make Your App COVID-19 Relevant

Times are not as usual. So will be the use cases for your app. Can you push quick updates on your app to make it relevant in these times?

PhonePe, one of India’s biggest UPI apps changed their app homepage overnight to show just the essentials allowed and necessary during the lockdown.

There’s a play there. Here are a few features the brands in the insurance sector can build:

a. social trackback

b. self-health check

c. locating health networks

What’s Next?

One thing that comes out in almost all our customer interviews is – We might never get back to the old normal. Post-COVID world will be a new normal world. The new normal will be empathy driven world. A more humane one.

That needs to translate into your messaging, engagement, and overall brand experience.

The brands that stayed relevant during the crisis were the ones who were agile to respond to the change and build their experiences around the tenets of empathy, creativity, and, personalized experiences.

Heena Shah from our MarTech Consultant team, had extensive interactions with our clients to bring in valuable insights that form the core of this blog.