In this blog, we explore why traditional customer churn prevention methods fall short, and why modern businesses need customer retention platforms that actively prevent churn, not just report it.

TL;DR

- What Is Customer Churn? Why Traditional Customer Churn Prevention Methods Fail?

- Most retention platforms report churn after it happens instead of preventing it.

- Early disengagement signals matter more than lagging revenue metrics.

- Preventing churn requires real-time, agentic marketing, not manual campaigns.

Most companies believe churn happens suddenly.

A customer cancels. A subscription expires. An account goes inactive.

That belief is comforting and dangerously wrong.

In reality, churn is rarely a moment. It’s a quiet emotional withdrawal that starts weeks or months earlier. By the time churn appears on a dashboard, the relationship has already thinned out, attention has shifted elsewhere, and winning the customer back now costs far more than keeping them ever would have.

This is the uncomfortable truth: Most brands don’t fail at retention because they lack data. They fail because they notice churn too late.

Most customer retention platforms are built for visibility, not intervention. Dashboards, cohorts, and reports scale easily. They explain what has already happened. But preventing churn requires judgment—deciding which customer is drifting, why their behavior just changed, and what action makes sense now.

That kind of real-time decisioning is harder to productize and riskier to own. Acting early means making probabilistic calls and sometimes being wrong. So most platforms stop at reporting and leave action to humans, campaign calendars, and delayed responses.

The result is a dangerous illusion of control. Brands know churn perfectly—yet still lose customers.

The next phase of customer retention demands a shift: from platforms that document churn to platforms that intervene before it happens. Because churn isn’t solved by seeing it clearly, it’s solved by stopping it early.

What Is Customer Churn?

Loyalty in 2026 is driven by relevance, timing, and intent—not points, programs, or promotions.

Customer expectations have fundamentally shifted. People no longer reward brands for showing up frequently; they reward brands for showing up meaningfully.

Here’s what’s different in 2026:

- From batch campaigns to real-time engagement: Static New Year calendars can’t keep up with dynamic customer intent.

- From identity-based segmentation to intent-based personalization: Age and gender matter less than behavior, hesitation, and readiness.

- From channel-first to journey-first marketing: Customers don’t think in channels—your strategy shouldn’t either.

- From discounts to differentiated experiences: Price incentives are now table stakes, not loyalty drivers.

In short, loyalty is no longer a program you launch—it’s a system you run.

Why Traditional Customer Churn Prevention Methods Fail?

Most churn prevention strategies look solid on paper. Dashboards are in place. Cohorts are tracked. Win-back campaigns are scheduled.

And yet, churn persists.

Traditional approaches usually rely on:

- Monthly or quarterly churn reports

- Rule-based triggers (e.g., “inactive for 60 days”)

- Generic win-back emails or discounts

- Loyalty programs focused on points, not behavior

These methods are not useless—but they are reactive by design.

Consider how many brands operate:

A customer goes inactive → a discount email is triggered → retargeting ads follow → silence continues.

By this stage, the brand is no longer competing on relevance.

It’s competing on price and usually losing margin in the process.Traditional systems explain churn exceptionally well.

They rarely prevent it.

Reinventing Churn Prevention With AI-Powered Retention Platforms

AI-powered customer retention platforms represent a structural shift, not a feature upgrade.

Instead of asking, “Who churned last month?”, these platforms ask:

“Who is likely to churn next—and why?”

This shift changes everything:

- From static reports → continuous monitoring

- From fixed rules → adaptive intelligence

- From campaign-based reactions → always-on journeys

In practice, this means churn prevention becomes proactive.

Brands like Amazon and Spotify don’t wait for inactivity to act. They continuously adjust recommendations, surfaces, and messaging based on subtle engagement changes—long before users consciously disengage.

The goal is no longer to win customers back. It’s to make leaving unnecessary.

Using AI to Analyze Customer Interactions in Real Time

Every customer interaction leaves a signal. On its own, each signal is meaningless. Together, they tell a story.

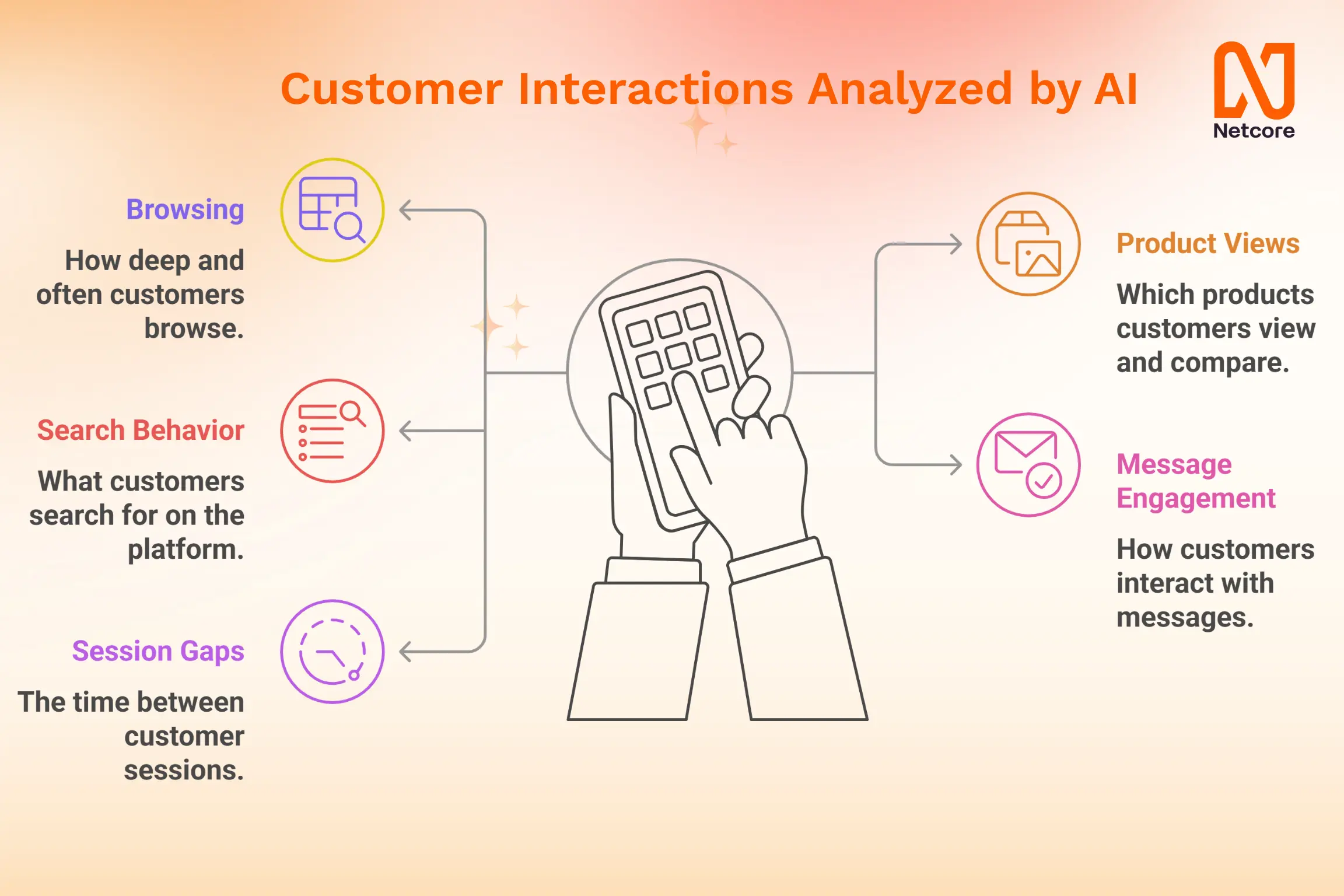

AI-powered platforms analyze patterns across:

- Browsing depth and frequency

- Product views and comparisons

- Search behavior

- Message opens, clicks, and skips

- Time gaps between sessions

For example:

- A shopper who used to browse 10 products per visit now browses 2

- A loyal app user opens push notifications but never clicks

- A repeat buyer starts comparing alternatives instead of purchasing directly

None of these trigger alerts are in traditional systems.

AI connects these signals into early churn patterns—the behavioral equivalent of stress fractures before a break.

Humans see snapshots. AI sees trajectories.

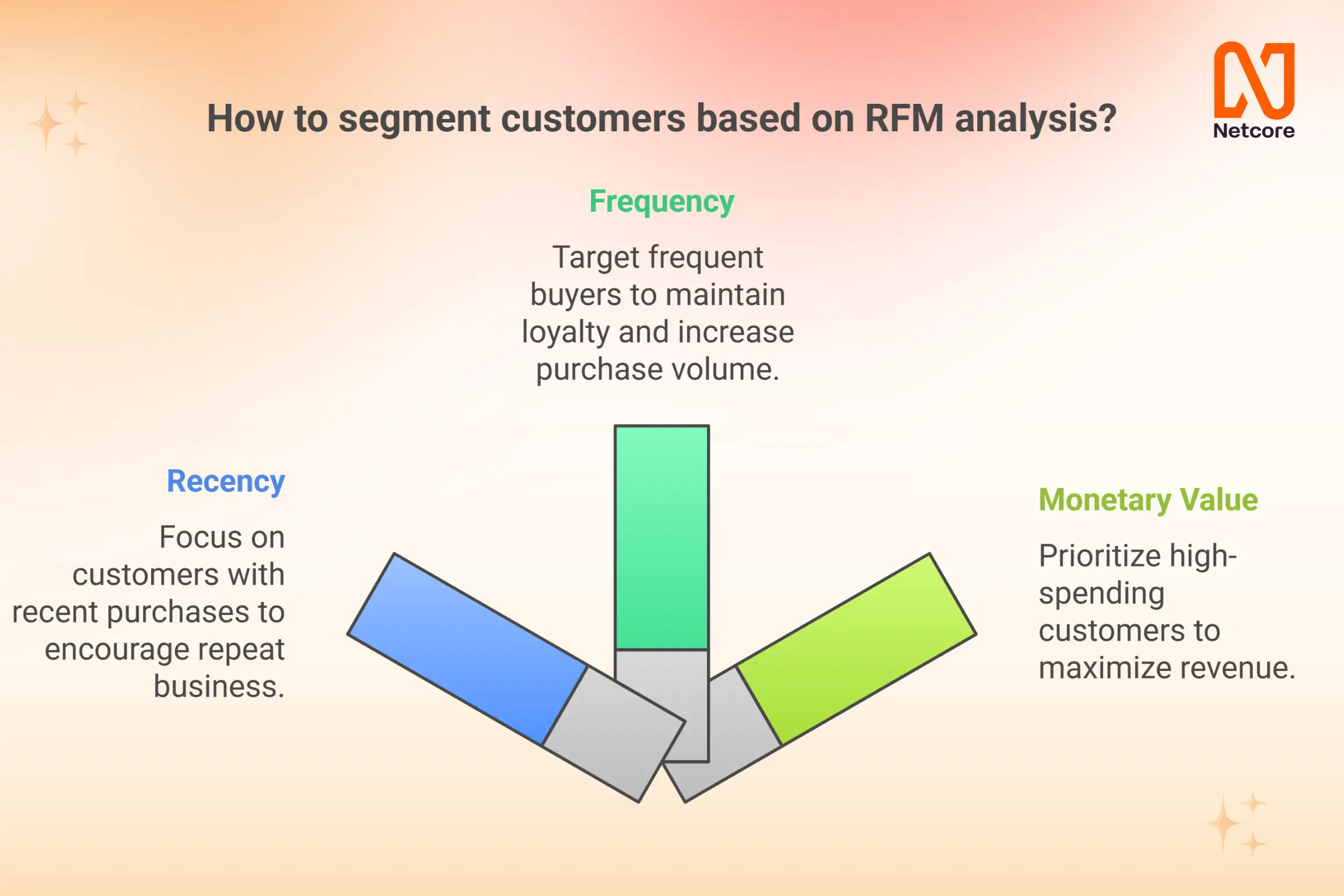

RFM Analysis: From Static Segments to Early Warning System

RFM (Recency, Frequency, Monetary value) has long been used to segment customers. Traditionally, it’s a periodic exercise, a snapshot of past behavior.

AI transforms RFM into a dynamic risk model.

Here’s how:

- Recency tracks decline trends, not just last activity

- Frequency identifies slowing momentum, not absolute counts

- Monetary value highlights which high-value customers are becoming vulnerable

For example, an ecommerce brand might discover:

- Its highest-spending customers are still purchasing

- But their purchase cycles are stretching

- And their exploration behavior has dropped

On paper, these customers look “safe.”

In reality, they’re drifting.

AI-powered RFM flags this risk early—while there’s still time to intervene without discounts.

Predictive Analysis: Turning Churn Risk Into Actionable Journeys

Prediction alone doesn’t save customers. Action does.

This is where many platforms stop short. They score customers as “high risk” and leave the rest to manual campaigns.

AI-powered retention platforms go further by automatically creating journeys based on churn intent.

Different customers receive different interventions:

- High-value loyal customers: reassurance, exclusivity, early access

- Hesitant customers: guided discovery, education, reduced friction

- Price-sensitive customers: targeted incentives—used sparingly

For example, Sephora doesn’t treat a high-value beauty enthusiast the same way it treats a deal-seeker. The intervention matches the relationship.

This is not automation for efficiency. It’s personalization for preservation.

Reporting platforms answer one question:

“What happened?”

Prevention platforms answer a harder one:

“What’s about to happen—and what should we do now?”

Picture a growth leader staring at a churn dashboard. The numbers are clear. The cohorts are slipping. But when it comes to action—who to target, what to say, and when—there’s silence.

Insight without intervention is theater.

The difference between reporting and prevention shows up early—long before churn appears in revenue metrics.

5 Early Signs Your Customer Retention Platform Is Preventing Churn

Sign #1: You See Disengagement Before Revenue Drops

Churn doesn’t start with cancellation.

It starts with silence.

Early disengagement shows up as:

- Fewer sessions

- Shallower browsing

- Sporadic opens

- Longer gaps between interactions

Reporting platforms flag churn after the last purchase.

Prevention platforms flag behavioral drift while revenue still looks healthy.

Revenue looked fine. Engagement was quietly collapsing.

How AI-Powered Retention Platforms Help

AI agents continuously monitor micro-behaviors across channels and detect patterns of disengagement, not just inactivity. Instead of waiting for churn events, it identifies customers starting to drift and triggers timely interventions while the relationship is still intact.

Sign #2: Your System Acts Without Waiting for a Campaign Brief

Most retention tools still wait for humans to react.

By the time a campaign is launched, the customer has already disengaged emotionally.

Prevention platforms intervene instantly:

- With relevance

- With guidance

- With reassurance

Reporting platforms escalate alerts. Prevention platforms take action.

Speed beats sophistication when churn is emotional.

How AI-Powered Retention Platforms Help

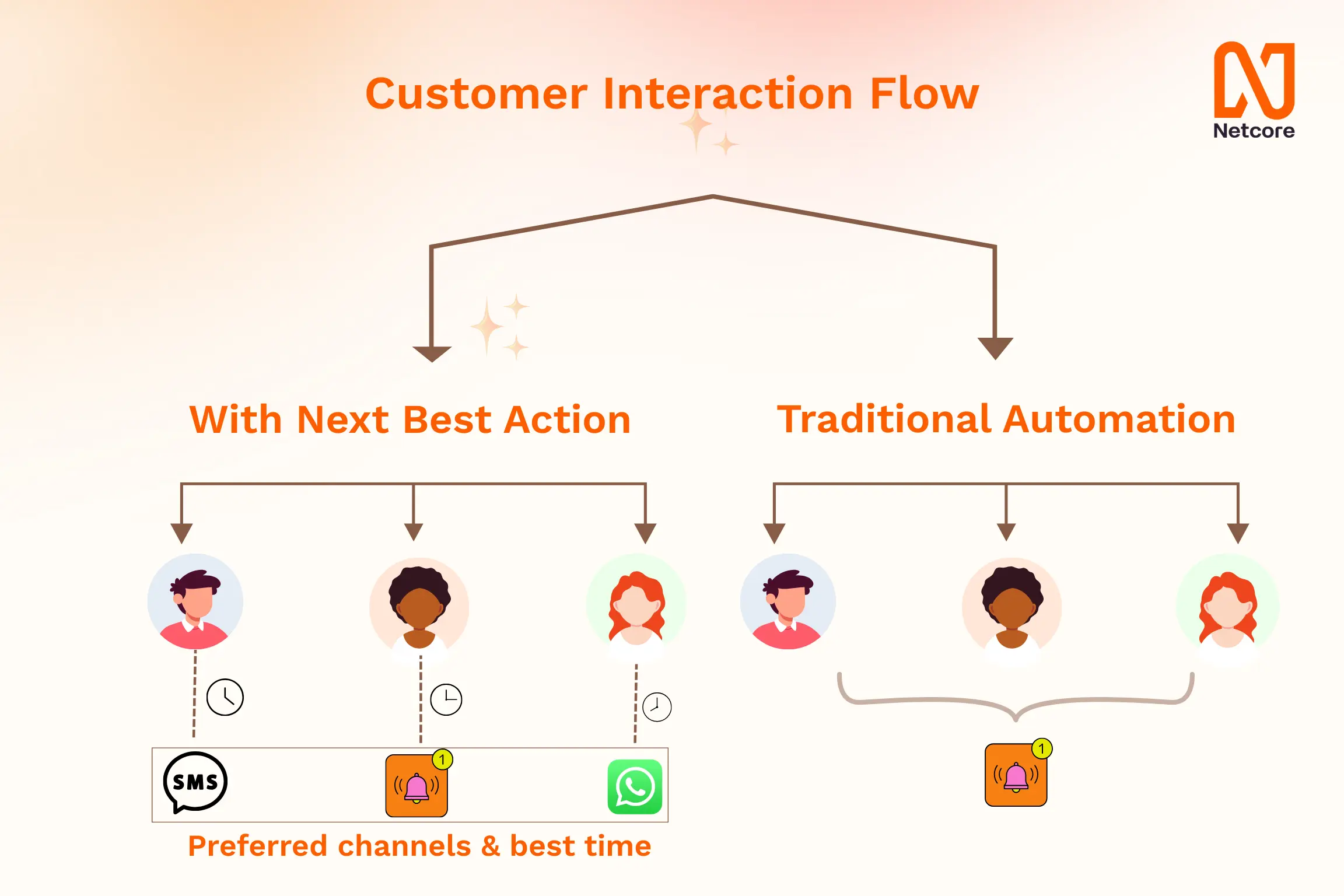

AI agents remove manual delays by automatically deciding the next best action in real time—personalized messaging, recommendations, or nudges—without waiting for campaign planning cycles or human intervention.

Sign #3: You Can Explain Why a Customer Might Leave, Not Just Who Did

Cohorts tell you who churned.

They rarely tell you why now.

Prevention platforms connect:

- Behavior

- Context

- Journey friction

Not “users dropped at step 3,” but:

“Users hesitated because choice overload created doubt.”

Customers don’t churn because of funnels.

They churn because of confusion, neglect, and friction.

How AI-Powered Retention Platforms Help

AI correlates behavioral signals with journey context to surface root causes of churn risk. It identifies why disengagement is happening and adjusts experiences—simplifying journeys, adding guidance, or changing messaging—before frustration turns into exit.

Sign #4: Interventions Change Based on Customer Value, Not Rules

One-size-fits-all retention is silent churn.

Reporting platforms send:

- The same reminders

- The same nudges

- The same offers

Prevention platforms apply judgment:

- High-value customers → reassurance, priority, exclusivity

- Price-sensitive customers → targeted incentives

- Hesitant customers → education and guidance

Two customers disengage. Only one is saved.

The difference isn’t messaging—it’s judgment.

How AI-Powered Retention Platforms Help

AI dynamically adapts interventions based on customer value, intent, and sensitivity, ensuring the right response for each customer instead of rigid, rule-based campaigns that over-discount or under-serve.

Sign #5: You Measure Churn That Didn’t Happen

Anyone can measure churn.

Almost no one measures churn avoided.

Prevention platforms track:

- Customers who showed exit signals

- But re-engaged

- And stayed

“The most valuable customers never appear in churn reports—because they never left.”

Retention success is invisible unless your system is designed to see it.

How AI-Powered Retention Platforms Help

AI models attribute retention outcomes by tracking counterfactuals, customers who were likely to churn but didn’t. This allows teams to measure prevented churn, not just lost customers, revealing the true impact of retention efforts.

Why Most Platforms Stop at Reporting

Reporting is easier than prevention.

Dashboards scale. Judgment doesn’t. Acting early requires real-time intelligence, adaptive models, and accountability, not just insights.

Many platforms were built for batch data and scheduled campaigns. They can explain yesterday. Few can act now.

Mature, retention-led organizations are shifting from analytics-first systems to action-first platforms, because they’ve learned a hard truth: Explaining churn doesn’t stop it.

Book a short call to evaluate your current retention setup and uncover where early churn signals are being missed.

Final Take

By the time a customer goes dormant, churn has already won. Dormancy isn’t the beginning of churn—it’s the end of a long, quiet process of disengagement. The real opportunity exists earlier, when customers are still present but slowly pulling away.

Manual efforts can’t operate at that speed or sensitivity. No team can continuously track thousands of micro-signals, interpret intent shifts in real time, and deliver the right intervention for every customer—without delay.

That’s why the future of churn prevention belongs to agentic marketing. AI-powered retention platforms don’t wait for inactivity or cancellations. They observe behavior continuously, detect early signs of disengagement, decide the next best action, and intervene automatically, before customers go silent.

The five early signs in this blog point to one conclusion: churn isn’t solved when customers leave. It’s solved in the moments just before they stop caring—and only platforms built to act autonomously in those moments can truly prevent churn and help increase CLTV..

Growth, decoded: Agentic Marketing Predictions 2026 for consumer markets. Read the report now.

Growth, decoded: Agentic Marketing Predictions 2026 for consumer markets. Read the report now.