Customer engagement guide lays the foundation for what modern banks need to thrive for. In 2026, banking is no longer just about managing money—it’s about managing relationships. And that’s where customer engagement in banking becomes a real differentiator. Think about it: customers aren’t lining up at branches for every query anymore. They’re tapping through mobile apps, asking questions on WhatsApp, expecting instant answers at midnight, and comparing offers from five different banks—all within minutes.

For most banks, this shift to digital-first engagement has brought new challenges:

- How do you keep up with customer expectations across so many channels?

- How do you personalize at scale when you’ve got millions of users?

- How do you create seamless, helpful experiences instead of fragmented ones?

That’s the real battleground now—not who offers the highest interest rate, but who makes their customers feel most understood.

In this blog, we’ll break down what meaningful customer engagement in banking really looks like today—what strategies actually work, what customers expect, and how banks can build trust and loyalty in an era where attention spans are short, but expectations are sky-high.

Let’s dive into your 2026 customer engagement playbook.

What is Customer Experience in Banking?

Customer experience (CX) in banking is no longer about just monthly statements and branch visits. It’s the sum of every interaction—across mobile apps, emails, support chats, and even ATM kiosks. Whether it’s a notification about a low balance or an upsell for a new savings plan, every moment matters.

Good customer experience in banking means:

- Anticipating needs before they arise

- Communicating proactively

- Removing all friction from daily financial tasks

- Offering support where and when it’s needed

In today’s environment, great CX is the new competitive advantage. A seamless, consistent, and personalized experience can build loyalty and trust, while even a single bad touchpoint—like a delayed transaction confirmation—can lead to customer churn.

Common Customer Expectations for the Digital Banking Experience

Let’s face it—today’s customers have Amazon-level expectations from their banks. Here’s what they want, and what banks need to deliver:

- Instant gratification: Nobody wants to wait 2 business days for a simple update. Customers want immediate service, whether it’s a fund transfer, a card block, or a credit score inquiry.

- Personalized over generic: A “Dear Customer” message doesn’t cut it anymore. Customers expect their banks to know their goals—whether it’s saving for a home or paying down a loan—and offer timely, relevant nudges.

- Omnichannel continuity: Whether someone starts a loan application on a desktop or checks an alert on WhatsApp, the experience should be seamless across channels.

- Security without complexity: Robust security measures should not create hurdles. Users expect smooth, password-less logins, biometric access, and secure but intuitive journeys.

Why Immediate Service and Personalization Are Non-Negotiables

Here’s the hard truth: If your bank isn’t responding fast, someone else is.

- Immediate service means faster resolution of issues, quicker decisions on loans, and instant updates on account activity.

- Personalized recommendations outperform one-size-fits-all campaigns. Whether it’s a travel insurance offer after a ticket purchase or a timely nudge to open an FD post-salary credit, context is everything.

Modern banking customers don’t want to be “sold to.” They want to be guided, supported, and understood. And that’s why customer engagement platforms matter. They help translate vast amounts of data into timely, meaningful interactions—at scale.

10 AI-Driven Customer Engagement Strategies for Banks

Here are 10 practical strategies to boost engagement across your customer lifecycle:

1. Hyper-Personalized Experiences with Segment Agent

Use Case: Deliver highly relevant content based on real-time behavior and transaction history.

- Automatically group customers by intent and preference—savers, investors, and frequent travelers.

- Dynamically personalize offers, like a suitable mutual fund for a first-time investor or a travel card for frequent flyers.

- Update these segments continuously—no manual rules, just real-time triggers.

Result: Offers hit fewer inboxes and fewer blind spots, increasing relevance and conversion.

Deliver Truly Personalized Banking Experiences, See How the Leaders Do It

2. New Touchpoints with a custom AI Agent on the app or website

Use Case: Convert customers without redirecting.

- Embed actionable widgets in WhatsApp, Email, or RCS.

- Customers can open accounts, upgrade loans or savings funds, or redeem loyalty points—all within the channel.

- No redirects. No friction.

Result: Higher conversion because you meet customers exactly where they are.

3. Map Journeys & Spot Friction with Insights Agent

Use Case: Understand where engagement drops and why.

- Track every stage: app onboarding ➜ feature use ➜ inactivity.

- Analyze funnel drop-offs—e.g., 45% abandon EMIs at the verification step.

- Receive prescriptive alerts like “reduce field count by 20%.”

You fix leaks fast, improving engagement and conversions organically.

4. Multichannel Consistency with Content Agent

Use Case: Personalized messaging across email, app, WhatsApp, and more.

- Auto-generate content variations—formal tone for older customers, casual for millennials.

- Optimize subject lines, CTAs, or message formats in real-time based on engagement benchmarks.

- Adapt copy for channel-specific experiences—emoji-rich for WhatsApp, clean banners for email.

Result: Cross-channel campaigns resonate better and yield higher opens and clicks.

5. Smart Rewards & Partnerships via Segment Insights

Use Case: Tailor loyalty incentives based on actual behavior.

- Identify top travelers, shopping enthusiasts, or card spenders.

- Serve them relevant rewards, like airline miles or partner discounts.

- Drive redemption through prompts at key moments (flight booking, festival seasons).

Result: Increased program participation and loyalty due to meaningful relevance.

6. Digital-First Experiences with Human Touch

Use Case: Blending AI with bank advisory for complex products.

- Insights Agent flags if users struggle with loan forms or investment decisions.

- Trigger human advisor outreach or smart chatbot help.

- Maintain digital-first efficiency while providing human reassurance.

Result: Higher completion rates on high-stakes journeys like home loans.

7. Frictionless Transitions with Synchronized Journeys

Use Case: Multi-device, multi-step interactions without loss.

- A WhatsApp chatbot uses targeted nudge campaigns to help users instantly pick up where they left off and finish their applications inside the WhatsApp channel.

- Customers begin on one device, say a browser, and finish on another—without repeating steps.

- Conversation history syncs in the background.

Result: Higher completion and lower dissatisfaction due to synchronized experience.

8. Data-Driven Interventions with Insights Agent

Use Case: Early detection of at-risk customers before they churn.

- AI identifies dormant transaction patterns or drop-ins in engagement.

- Push customized “missed you” offers or reminders—personalized, not generic.

- Use diagnostic strength to attribute why they are drifting and how to win them back.

Result: Reduced churn and reactivated relationships—before it’s too late.

9. Predictive Analytics for Proactive Offers

Use Case: Anticipate needs before they occur.

- Predict which customers are ready for a credit card, personal loan, or investment account.

- Trigger campaigns or in-app nudges with tailored messaging.

- Eliminate guesswork from targeting high-uptake users.

Result: Higher uptake and efficiency, with reduced cost per conversion.

10. Real-Time, Responsive Communication

Use Case: Automated triggers that spark at the right moment.

- Intelligent product recommendations can be used to up-sell banking products on the trigger of the right event, like “Your FD matures tomorrow. Auto-renew?”

- Real-time prompts enhance urgency and convenience.

- Every message is tailored—timed, formatted, and optimized.

Result: Faster decisions, improved satisfaction, and measurable uplift in conversion rates.

Case Studies: How Netcore Boosted Customer Engagement Across Leading Banks

Here’s how leading banks across the globe are transforming their engagement and communication strategies using Netcore’s Customer Engagement Platform:

- Axis Bank (India): Achieved a 227% increase in click-through rates with dynamic, interactive email content, like countdown timers, videos, and branded sender identities.

- Polaris Bank (Nigeria): Boosted email open rates by 30%, click-through rates by 10%, reduced bounces by 10%, and cut unsubscribe rates by 20% by leveraging advanced segmentation and send-time optimization.

- Danamon Bank (Indonesia): Recorded a 14% CTR and a 59% open rate, 3.5× higher open rates and 12× higher CTR than regional benchmarks by streamlining email automation and delivery.

- Kotak Mahindra Bank – Kotak 811 (India): Doubled open rates and click-to-open rates through targeted “micron series” email reactivation campaigns supported by smart segmentation and lifecycle targeting.

- Fidelity Bank (Nigeria): Attained an average 46.5% open rate, with bounce rates dropping by over 60%, powered by real-time analytics and robust list hygiene strategies.

- Equitas Small Finance Bank (India): Observed a 130% increase in click-throughs and a 32% uplift in open rates by using optimized send-time personalization.

- IndusInd Bank (India): Boosted credit-card application activation rates to 75% within 75 days through intelligent early lifecycle campaign automation.

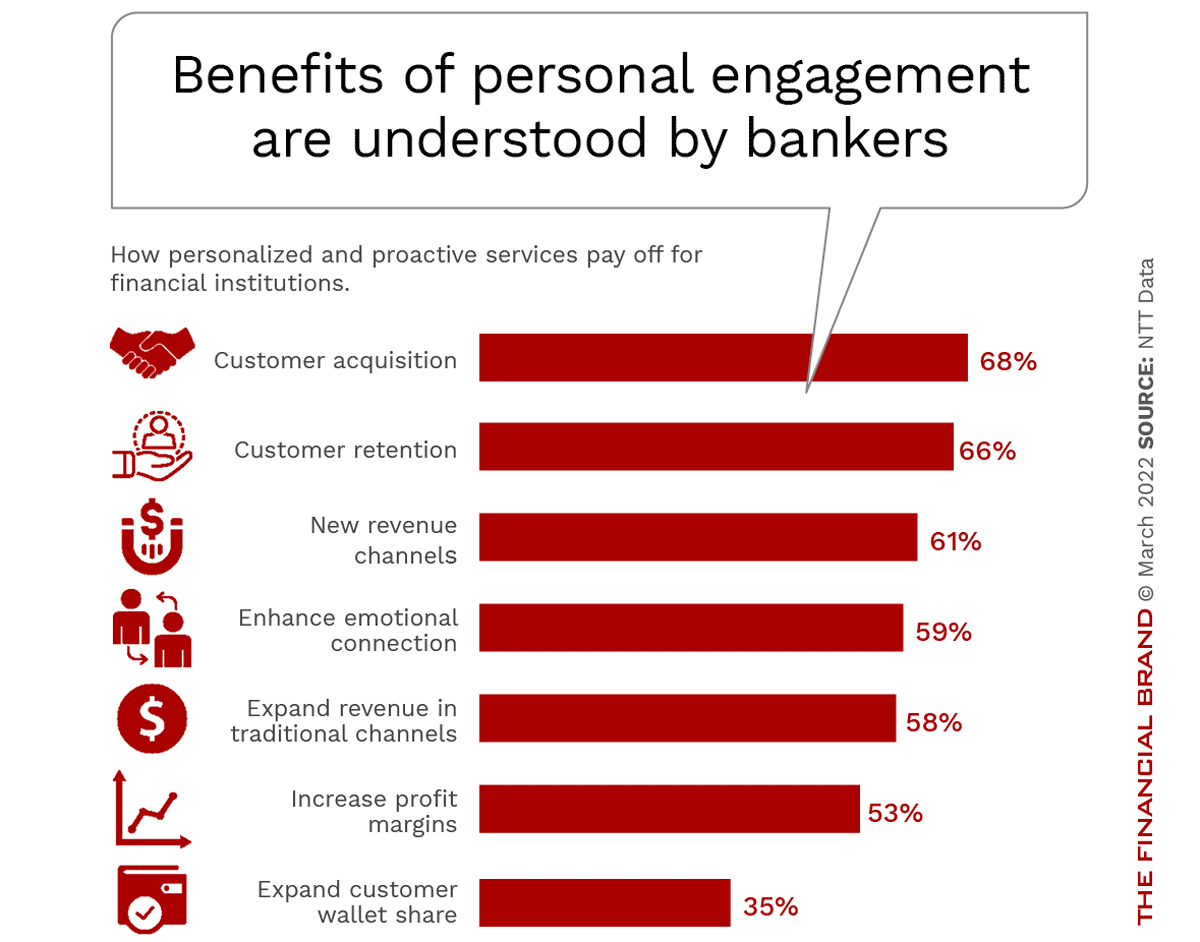

The Bottom Line: Personalization Is the New Competitive Moat in Banking

If you’re a CMO, Head of Customer Retention, or Product Leader in the banking space, here’s what truly matters:

- Real-time, relevant engagement isn’t just a customer preference; it’s a business mandate.

- Banks using customer engagement platforms are already seeing 2× higher email open rates, 130% increases in CTR, and up to 75% growth in product activation.

- You don’t need to overhaul your stack adoption is seamless, with dedicated onboarding and support to get you up and running fast.

- Every day you delay, you risk missing conversions, abandoned journeys, and lower LTV, because your customers are already expecting intelligent, timely engagement.

Want to see how leading banks are turning engagement into measurable growth?

Click below to schedule a free 1:1 personalized session. You’ll get:

- A tailored engagement roadmap for your customer lifecycle

- Insights into what’s underperforming and how to fix it

- Real-world benchmarks and examples from top banks

Book Your Banking Engagement Strategy Session. Start turning engagement into ROI, retention, and relevance—right now.

Worried About Your AI Marketing Strategy? Read the Agentic Marketing 2026 Predictions Report! →

Worried About Your AI Marketing Strategy? Read the Agentic Marketing 2026 Predictions Report! →