Traditional RFM shows who’s loyal or at risk—once. Because customer behavior is never static, your system needs to evolve with every shift—capturing how users change, not just who they are in a single moment. Netcore’s Analytics 2.0 RFM shows how customers move, who you can actually reach, and when to act. It adds RFD (Duration) to capture hidden intent and builds reachability and activation right into the view. Plum Goodness used Netcore’s RFM framework and cohort insights to create 25+ micro-segments, run a mobile-first, multi-channel strategy, and achieve 1.4X uplift in repeat purchases and 1.7X uplift in revenue from repeat buyers.

You’ve seen RFM before—colorful blocks, one-time snapshots, static “loyal” or “at-risk” labels.

But here’s what they rarely tell you:

- How your customers move between RFM segments in real time.

- How Duration (RFD) reveals hidden intent your Monetary scores can’t.

- How users spread across segments—and where your biggest opportunities lie.

In short: most RFMs are reports, not decision engines.

Over the last year, we rebuilt RFM for today’s engagement reality. In Analytics 2.0, RFM becomes a live, actionable map of customer value and evolution—with a new lens: RFD (Recency–Frequency–Duration) to surface hidden intent.

1. What Is RFM? (And Why Does Every Growth Team Rely On It?)

The way brands understand customers has changed dramatically over the past few years. Traditional segmentation was built on static rules and outdated snapshots, often telling marketers who a customer used to be, not who they are today. Netcore Cloud’s upgraded RFM Analytics doesn’t just categorize customers—it creates a live intelligence engine that captures three essential behavioral dimensions in real-time:

- Recency: How recently a user performed an action

- Frequency: How often the user performs it

- Monetary / Duration: How much they spend or how long they engage

What you get is not a report—but a live intelligence engine that reveals:

- Who your most valuable users are

- Who is slipping, churning, or accelerating

- How customers move across segments

- Who you can actually reach before activating campaigns

The output helps marketers in generating more intelligent segments, transitions, and distributions that helps drive retention, repeat revenue, and long-term loyalty.

This evolution turns RFM into a central part of retention, personalization, and revenue strategy.

Capability #1: RFM Segmentation

RFM segmentation used to be a simple framework, but in Analytics 2.0, it transforms into a flexible, customizable, and industry-specific engine. Netcore supports three core models—RF, RFM, and RFD—each designed to fit different use cases.

2.1 RF Model (Recency + Frequency): Engagement-First Segmentation

Best-Fit Industries & Use Cases

The RF model shines in industries where engagement matters more than spending:

- BFSI and Fintech platforms tracking user activity and feature adoption

- OTT and Streaming services measuring viewer engagement

- News and Media apps counting readers and content consumption

- App-first brands optimizing for MAU, WAU, and DAU

- EdTech platforms monitoring learning streaks and course progress

- Social platforms building around daily habits

If your key metric is activity; whether it is MAU, WAU, DAU, stickiness, or session counts, RF is the perfect fit.

What the RF Model Does

RF lets marketers build segments based solely on how recent and how often users perform a chosen event.

Popular RF segment types include:

- WhatsApp Reads RF: Understanding message engagement to optimize communication timing

- Email Click RF: Identifying your most engaged email subscribers versus those going cold

- App Launch RF: Spotting habitual users versus those at risk of abandoning your app

- Page View RF: Tracking content consumption patterns across your website or platform

- Feature Usage RF: Monitoring adoption of specific product features or tools

These help brands understand who is active, who is slipping, and who is about to churn—all without requiring any monetary inputs

2.2 RFM Model (Recency + Frequency + Monetary): Revenue Intelligence at Scale

RFM is the classic model, but our version is rebuilt for speed, flexibility, and accuracy.

RFM becomes the strategic backbone for any business where revenue and spending patterns directly indicate customer value:

- E-commerce and online retail tracking purchase behavior

- D2C brands building direct relationships with buyers

- Travel and Hospitality managing booking patterns

- Food Delivery optimizing order frequency

- Marketplaces balancing supply and demand

Where revenue matters, the Monetary score becomes your most powerful signal.

What Makes Netcore’s RFM Unique

Here’s where generic RFM tools fall short and Netcore pulls ahead. Our platform gives marketers unprecedented control to define:

- Custom spending windows that match your actual business cycles

- Flexible monetary ranges that reflect your pricing structure

- Payload-based monetary scoring pulled directly from event properties like order amount, cart value, or transaction size

This flexibility means your RFM model mirrors your actual revenue patterns.

Examples of High-Value RFM Use Cases

- Identify Rising Stars or Loyal customers for loyalty and VIP programs

- Build At-Risk campaigns to save high spenders

- Improve reorder frequency with personalized nudges

- Optimize lifecycle journeys based on value clusters

2.3 RFD Model (Recency + Frequency + Duration): The Missing Layer for Content Brands

Some industries don’t rely on revenue for segmentation—because value comes from time spent, not money spent.

Duration-based segmentation is purpose-built for:

- OTT platforms measuring binge behavior and watch time

- News media tracking reading depth and article completion

- Audio streaming services understanding listening patterns

- Gaming apps monitoring session length and play frequency

- Content-heavy apps of any kind where engagement time equals value

The Duration unlocks insights that Monetary never could:

- Depth of engagement: Are users skimming or truly immersed?

- Content affinity: Which genres, topics, or formats keep them coming back?

- Binge behavior: Who are your power users consuming content voraciously?

- Early warning signals: When is duration dropping before frequency follows?

RFD helps platforms with content as a product understand who their real power users are; the ones who might never pay but whose engagement drives everything from ad revenue to social proof to network effects.

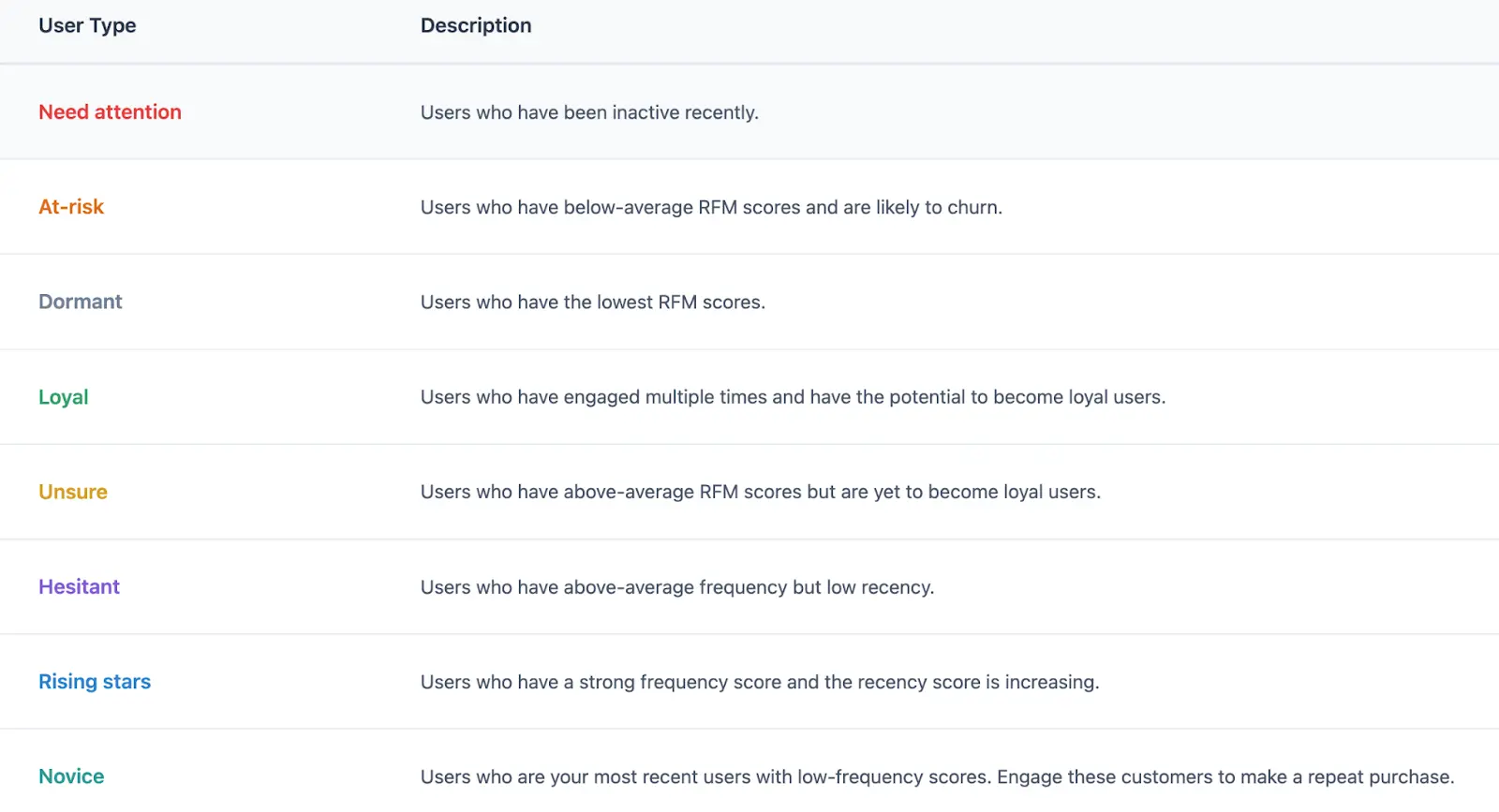

2.4 Output of RFM: Netcore’s 9 Behavioral Segments

Netcore automatically generates nine ready-to-use clusters:

3. Capability #2: RFM Transitions (The Behavioral Story Behind the Segments)

Static snapshots are not enough in 2025. What matters is movement.

Transitions show how customers shift between segments over time. Knowing that someone is “At Risk” today is useful. But knowing that they were “Loyal” last month and have just transitioned to “At Risk”? That’s actionable intelligence that changes everything.

Examples of transitions include:

- Loyal → Unsure: Trigger timely win-back flows

- Rising Stars → Loyal: Encourage progression with incentives

- Novice → Rising Star or Loyal: Improve onboarding journeys

- Need Attention → Dormant: Launch urgent reactivation pushes

Why Transitions Matter

Transitions help marketers:

- Detect churn early

- Track recovery after campaigns

- Understand adoption and habit formation

- Predict future behavior

- Intervene before the customer leaves

This transforms RFM from a “chart” into a behavioral movie.

Where Reachability Fits In

Netcore shows reachability across channels like:

- Push

- SMS

You can act instantly only on customers you can reach. This ensures no effort is wasted.

4. Capability #3: RFM User Distribution

Distribution provides a bird’s-eye view of how customers are spread across Recency, Frequency, and Monetary ranges.

4.1 Recency Distribution

Helps answer:

- Are users fresh or aging out?

- How many are showing early drop-off signs?

Typical buckets include:

0–1 days, 2 days, 3 days, 4–7 days, 8–14 days, 15–30 days, 30+ days.

4.2 Frequency Distribution

Helps identify:

- Heavy vs light users

- Feature or purchase frequency patterns

Typical buckets include:

1 time, 2–5, 6–10, 10–20, 20+

4.3 Monetary Distribution

Shows revenue concentration:

- Who spends the most

- Who needs nurturing

- Where upsell potential lies

Buckets:

1–100, 101–200, 201–300, 300–500, 500+

Cross-Capability Advantage: Instant Actionability — From Insight to Impact in Seconds

One of the biggest frustrations for marketers today is the gap between understanding the customer and acting on that understanding. Insights are plentiful—but activation is painfully slow.

Analytics 2.0 closes that gap completely.

With Netcore’s cross-capability action layer, every insight becomes immediately actionable, empowering marketers to move at the speed of customer behavior—not after it.

Here’s where the magic happens:

- Create campaigns instantly, right from the segment view: Netcore allows you to use the segment view as an opportunity to launch a campaign instantly.

- Check channel reachability before you hit send: Whether it is Email, SMS, WhatsApp, Push; know exactly who you can reach and how, and ensure that your message actually lands.

- Trigger journeys automatically based on movement: When a user shifts segments from Loyal to At-Risk or Novice to Rising Stars; the system responds for you. Netcore helps you trigger journeys based on these transitions, thanks to our behavior-driven automation.

- Download eligible lists with a single click: Whether for analysis, enrichment, or external activation, your audience list is always ready to be exported.

With these capabilities woven seamlessly across RFM segments, transitions, and distributions, Analytics 2.0 removes every ounce of friction between insight and execution.

It turns analytics from a passive reporting layer into a proactive growth engine, letting marketers act in the moment that matters—every single time.

How Brands Across Industries Use RFM

Below is a closer look at how RFM actually works in real industry contexts, with examples that paint a clear picture of how teams use it every day.

E-Commerce: Turning Browsers Into Repeat Buyers

E-commerce teams live and breathe promotion cycles, abandoned carts, and repeat purchases. RFM gives them a behavioral lens to know exactly which users to target, when, and with what message.

1. Target high cart-value + low recency users with high-intent nudges

Imagine a shopper who added ₹8,000 worth of products to their cart last week but hasn’t returned in 10 days. RFM flags this user as:

- High Monetary

- Low Recency

- Low Frequency

This is the perfect moment for:

- A free shipping reminder

- A limited-time discount

- A price-drop alert

- Or even a personalized “Your cart is waiting” push

Instead of blanket offers, brands use RFM to prioritize high-value shoppers who are close to making a decision but slipping away.

Compare “Rising Loyalists” vs. “Dormant” users by category

Not all categories behave the same. A user might be:

- Rising in Skincare (frequent purchases)

- Dormant in Haircare (hasn’t bought in months)

RFM helps category managers:

- Plan targeted discounts only where needed

- Push loyalty programs for growing categories

- Avoid over-discounting categories that are already performing well

- Identify users who need education (e.g., regimen guides in Beauty)

This leads to smarter merchandising and more relevant campaigns.

FinTech: Protecting High-Value Investors Before They Churn

In FinTech, trust and habit are everything. A user who invests often but suddenly stops is a far bigger signal than a missed deposit.

RFM gives retention and product teams a reliable early-warning system.

1. Track transitions from Rising → At-Risk → Dormant

For a wealth management or investment app, a user might:

- Deposit weekly for months (High Frequency)

- Build steady AUM (High Monetary)

- Then suddenly stop transacting (Recency drops)

RFM automatically flags the transition:

- Rising Star → At Risk (recency decline)

- At Risk → Dormant (extended inactivity)

FinTech teams use this to:

- Send expert commentary

- Push market insights

- Recommend SIP top-ups

- Offer portfolio check-ins

- Trigger RM follow-ups

The goal: intervene before AUM starts shrinking.

2. Use Frequency × Monetary to prioritize support

Two users may both be inactive for 15 days, but:

- User A invests ₹1 lakh a month

- User B invests ₹2,000 a month

RFM helps:

- Identify high-value yet low-recency investors

- Prioritize them for high-touch support

- Personalize win-back campaigns

- Deploy human RM calls more effectively

It’s retention with precision, exactly what regulated FinTech brands need.

Travel & Hospitality: Timing Is Everything

Travel operates on cycles, ranging from 3-month domestic trips to annual holidays. RFM helps brands understand these natural rhythms so they can show up at the right moment.

1. Identify 3–6 month repeat travelers and build loyalty journeys

Some users travel every quarter. Some only during summer. RFM surfaces these patterns:

- High Frequency domestic travelers

- Seasonal vacationers

- International “once-a-year” flyers

- Business travelers with stable recency patterns

With this, teams can:

- Offer pre-trip planning nudges

- Push early-bird discounts

- Unlock loyalty tiers

- Recommend packages before search intent peaks

It feels less like marketing and more like thoughtful timing.

2. Compare recency windows for domestic vs. international travelers

Domestic trips:

- Recency windows often range 30–90 days

International trips: - Recency windows stretch to 6–12 months

RFM lets travel brands:

- Build segment-specific promo cycles

- Time sales around typical planning windows

- Prioritize long-haul travelers for early notifications

- Run pre-departure engagement (insurance, add-ons, upgrades)

This reduces wasted spend and increases booking velocity.

Media & Subscriptions: Where Duration Becomes the Real Currency

OTT, media, audio, and content platforms rely on one thing above all else: time spent. That’s why many of them adopt RFD (Recency, Frequency, Duration) instead of RFM.

1. Find “binge-but-trial” users and convert them to paid plans

Picture a user on a trial plan who watched 12 hours of content over the weekend. RFD instantly highlights them as:

- High Duration

- High Frequency

- High Recency

This is the ideal upgrade moment.

Teams use RFD signals to:

- Recommend top shows

- Offer early upgrade incentives

- Trigger personalized “You might love this next” nudges

- Highlight premium-only content

This converts trial users with pinpoint precision.

2. Catch renewal risk early by watching frequency drops

A long-term subscriber who suddenly:

- Streams less often

- Stops bingeing

- Switches to short sessions

“…is displaying early signs of churn.” In RFD terms, they move from:

- Frequent → Low Frequency

- Long Duration → Short Duration

- Loyal → At Risk

Platforms use these signals to:

- Send “Continue Watching” nudges

- Recommend new genres

- Offer subscription extensions

- Re-engage via personalized picks

This helps prevent renewal drop-offs and lifts monthly retention rates.

Real Stories: How Brands Used RFM, Funnels & Cohorts to Unlock Growth

To bring the RFM framework to life, here are two case studies that show how brands transformed retention, repeat purchases, and revenue by combining RFM with Funnels and Cohort insights. These stories don’t just validate the model, they show exactly how different brands operationalized it.

Case Study 1: Plum Goodness

Using RFM + Cohorts to Achieve 1.7X Revenue Growth

Plum Goodness, one of India’s most loved clean-beauty brands, wanted to deepen customer loyalty and scale repeat purchases across their app and website. Instead of relying on broad campaigns, the team decided to anchor their retention strategy in RFM segmentation and Cohort Analysis.

How Plum Used RFM

Plum started by activating all 9 predefined RFM segments, then expanded them into 25+ micro-segments to get a sharper, behavior-led view of their customer base. This allowed them to identify:

- High-value, high-frequency loyalists

- New buyers with high potential

- At-risk and dormant users needing reactivation

- Category-specific pockets of opportunity

How Plum Used Cohorts

The team layered Cohort insights on top of RFM segments to analyze:

- Week-on-week repeat purchase behavior

- Drop-off moments in the purchase lifecycle

- Time windows with the highest probability of repurchase

Cohort analysis helped Plum connect the “who” (RFM segments) with the “when” (Cohort repeat cycles), enabling precisely timed interventions.

Channel Mix + Behavioral Segments = Massive Uplift

Plum didn’t stop at segmentation, they operationalized it across WhatsApp, RCS, SMS, and App Push to meet users where they were most active.

The Impact

Plum achieved:

- 130% uplift in repeat purchases on the website

- 140% uplift on the app

- 1.7X uplift in revenue from repeat buyers

All directly tied to the interplay of RFM + Cohorts + channel personalization.

Why This Case Study Matters

This is a textbook example of how Engine 1 (RFM Definitions) + Engine 2 (Transitions & Segments) + Engine 3 (Cohort-driven Distribution) work together. Plum didn’t guess, instead they acted on user behavior patterns.

It shows exactly what happens when a brand stops treating users as one mass audience and starts understanding how recency, frequency, and transitions between segments shape repeat purchase probability.

Case Study 2: Pepe Jeans

Locking in 2.6X Conversions by Combining RFM, Funnels & AI-Powered Affinity

Pepe Jeans needed to fix a few big challenges:

- generic targeting,

- low repeat purchases,

- inefficient WhatsApp spends, and

- poor funnel visibility.

The brand inverted its entire strategy by using RFM, Funnel Analytics, Cohort Patterns, and AI-based timing optimization.

Where Pepe Jeans Started

The challenges were clear:

- Campaigns relied on “last opened” or “add-to-cart,” not behavior

- WhatsApp blasts ignored user timing preferences

- No distinction between one-time vs. loyal buyers

- Deliver-to-conversion ratio was an alarming 76:1

How Pepe Jeans Used Funnels

Pepe Jeans began by analyzing Total Conversion Funnels to understand:

- Where users drop off

- Which segments convert efficiently

- Which channels produce the best ROI

This was critical for fixing the WhatsApp inefficiency. They also used Funnel Efficiency tracking to measure true ROI.

How Pepe Jeans Used RFM

RFM became the foundation of their retention strategy:

- Identifying high-value repeat buyers

- Differentiating one-time vs. returning buyers

- Layering affinity categories (Denim, Tops, Accessories) on RFM clusters

This let them build precise segments like:

- “High Value + High Denim Affinity”

- “At-Risk + High Monetary”

- “Dormant but High AOV”

“Pepe Jeans created RFM-based segments… reinforced with Affinity filters to build hyper-focused user groups.”

How Cohorts Fueled Repeat Purchases

Using Cohort Analytics, the brand identified:

- Which weeks had the highest re-purchase probability

- How often users repeated purchases across 12 weeks

- How RFM segments performed across cohorts

These insights directly influenced their retention journeys.

AI Send-Time Optimization (STO) Boosted Conversions

Instead of blasting messages at fixed times, Pepe Jeans used Netcore’s STO to send each user the WhatsApp message at their peak engagement window.

This alone:

- Improved delivery rates by 25%

- Increased engagement by 1.8X

- Cut wasted sends

- Overcame Meta frequency caps

The Impact

Across 90 days, Pepe Jeans achieved:

- 2.6X conversion growth

- 57% improvement in funnel efficiency

- 11X ROI on WhatsApp

- 13X ROI on Email

All attributed to the structured use of RFM + Funnels + Cohorts.

Why This Case Study Matters

Pepe Jeans didn’t just segment—they operationalized RFM at scale. This case perfectly illustrates:

- How Engine 1 (Defining RFM Values) identifies high-focus clusters

- How Engine 2 (Transitions + Funnels) finds inefficiencies and opportunity paths

- How Engine 3 (Distribution + Cohorts) drives repeat behavior

The combination of RFM (the who), Funnels (the how), and Cohorts (the when) produced a level of precision that transformed not just conversions but ROI and retention.

What’s Next in Analytics 2.0

- Cohorts 2.0: Visualize retention and repeat patterns by segment.

- User Paths: Understand why some loyalists drift and where to fix it.

- Cross-Module Insights: Combine Funnels, Cohorts, RFM, and Paths for a complete growth view.

Existing Customers:

Ask your CSM to enable RFM Transitions, RFD, User Distributions, and Reachability. Request a strategy session to define micro-segments and optimize campaigns.

New to Netcore?

See RFM 2.0 in action with your data:

👉 Book a demo .

Conclusion

RFM in Analytics 2.0 isn’t just segmentation; it’s a growth engine that thinks in motion.

You can see who’s loyal, who’s rising, and who’s slipping.

You can detect intent before it becomes conversion and reach customers before they disappear.That’s the future of analytics: real-time, actionable, and built for impact.

Worried About Your AI Marketing Strategy? Read the Agentic Marketing 2026 Predictions Report! →

Worried About Your AI Marketing Strategy? Read the Agentic Marketing 2026 Predictions Report! →