Most marketers focus on customer acquisition. But growth doesn’t come from just getting customers—it comes from nurturing them.

That’s why the most important questions aren’t: “How do I get more signups?” but:

- “How do I retain customers better?”

- “What makes customers come back?”

- “Who’s most likely to churn—and why and when?”

But in most MarTech tools, Customer Cohorts are static charts. They’re hard to segment, and even harder to act on.

So we’re introducing Netcore’s all-new Cohorts, which have best-in-class capabilities that help marketers confidently answer and act on all these questions.

Introducing Cohort Analysis

Since Cohort Analysis isn’t often a go-to tool, let’s first understand it.

Cohort Analysis groups users who share a common trait (like signup date, purchase event, or feature adoption) and tracks their behavior over time. It helps measure a specified metric of a specific user group across different days, revealing real-life patterns and behavior among other groups.

It helps you answer questions like:

- How many users returned on Day 7?

- What % made a repeat purchase in the first month?

- Do those who installed on day 0 uninstall the same day or later?

By understanding behavior among user groups over time, marketers can create targeted experiences that influence the user’s journey down the funnel.

Increasing acquisition is great, but it hides an important measure of sustainable growth—customer retention, which is uncovered in Cohort Analysis. After signing up to your website or app, which users take actions in how many days? Answers to these questions reveal how your users engage with your website/app after signing up.

The limitations of outdated cohort analysis

Most Cohorts today are limited in:

- Not actionable: You see the drop, but can’t act on it right away

- Reachability: You see day 7 retention is low, but you don’t see their channel-wise reachability

- Limited drill down capabilities: Limited depth into city, OS, source, or segment-wise performance

- Segment comparison in Cohorts: Limited capabilities to compare cohort behavior across segments.

Retention is both a segment-level problem and a timing problem. You need both to act.

Netcore Cohorts: Purpose-built for actionable retention

Netcore Cohorts go beyond when users return. You’ll learn who they are, what they do, and how they behave across dimensions and segments.

Netcore’s Cohorts aren’t just reports. You’ll know which micro-segments are loyal — and which ones need a nudge. Netcore Cohorts are dynamic, interactive tools that let marketers analyze and act in the same workflow. Here’s how:

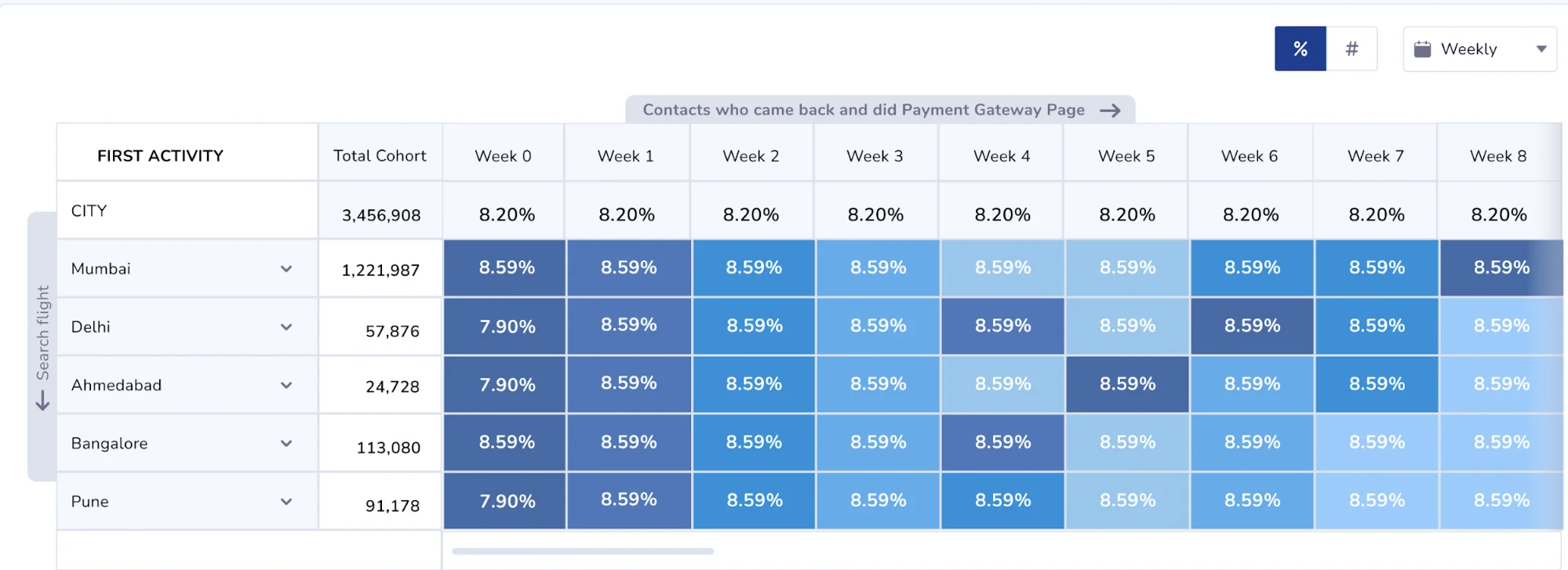

Gain deeper insights with drill downs by demographics and behavior

Retention isn’t one-size-fits-all. A 20% Day 7 retention rate looks very different if you analyze it by device type, app version, or geography.

Netcore Cohorts let you drill down by:

- Demographics: City, age group

- Technographics: OS, app version, device type

- User Attributes: Add to cart, Checkout, Order value

Retention patterns are often hidden in subgroups. For example, you might discover that iOS users retain twice as well as Android users—but only in certain cities. Or that a new app version influenced retention in one age group while boosting it in another.

Benefit: Instead of treating all users equally, marketers can craft hyper-specific re-engagement campaigns. For example, a travel app might discover that “first-time Android users in Tier 2 cities” don’t activate their accounts at all, and design onboarding flows tailored to them.

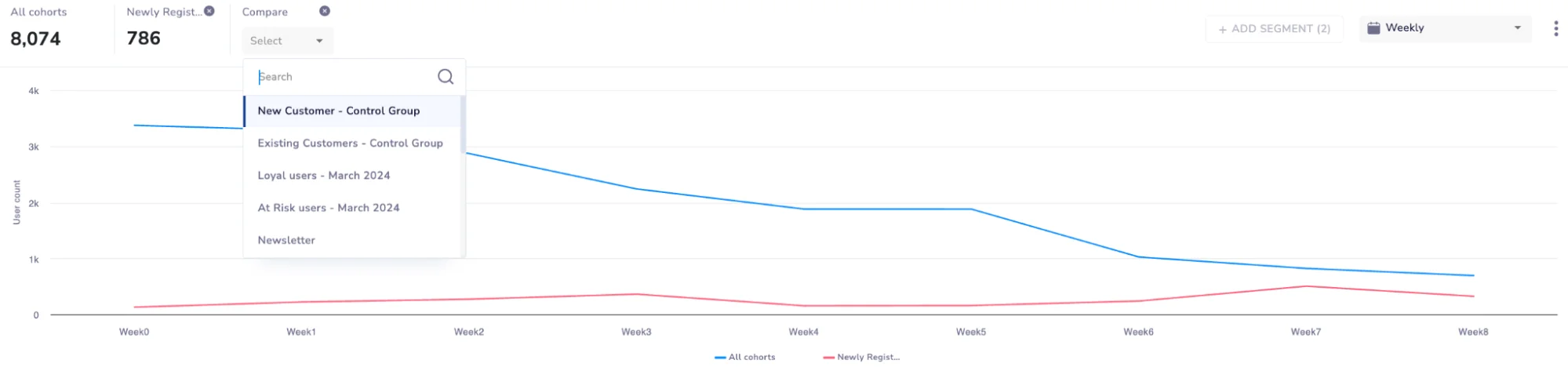

Compare Cohorts and spot trends

Not all segments are equal. Some bring loyalists, others bring window shoppers.

Netcore Cohorts let you compare segments like:

- Jeans buyers vs shirt buyers

- Promo-driven vs regular buyers

- New vs returning customers

- Loyal vs at risk users vs dormant users vs seasonal buyers

Instead of arguing about whether promotions campaigns “work,” you can prove it with retention data: Do promo-acquired users stick around as long as regular ones? If not, what’s the real cost of that campaign?

Benefit in action: An ecommerce store might find that trial signups from referral campaigns purchase 2x more than regular ones. That insight helps marketing double down on referral incentives instead of burning cash on low-retention campaigns.

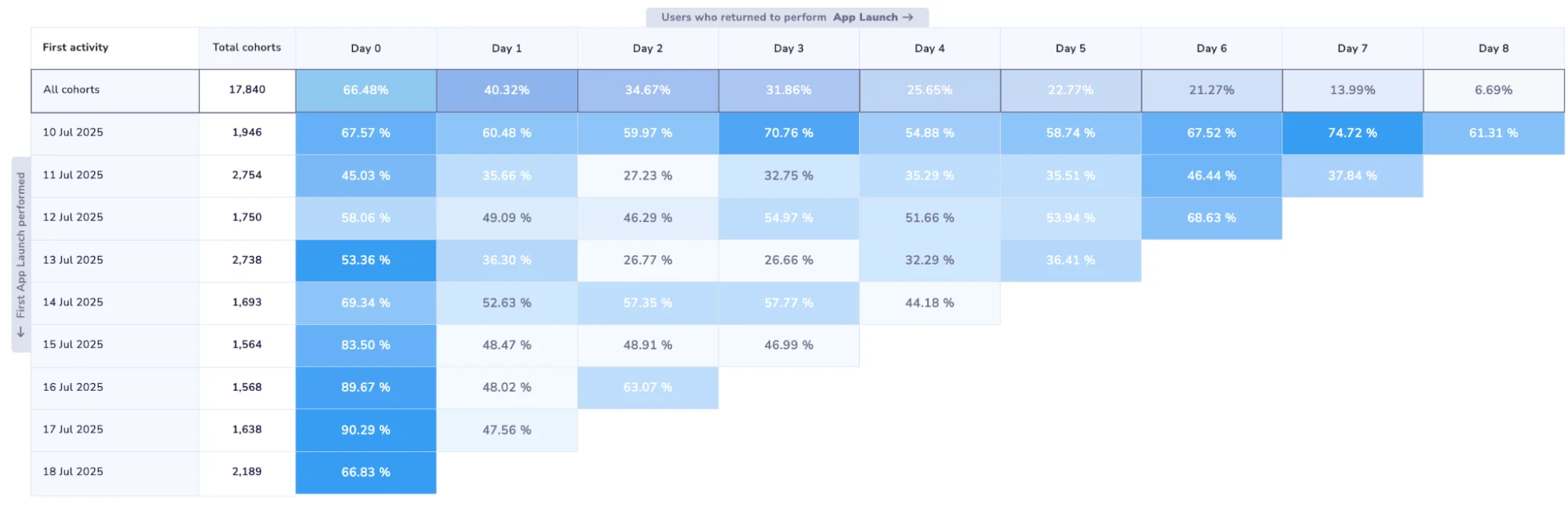

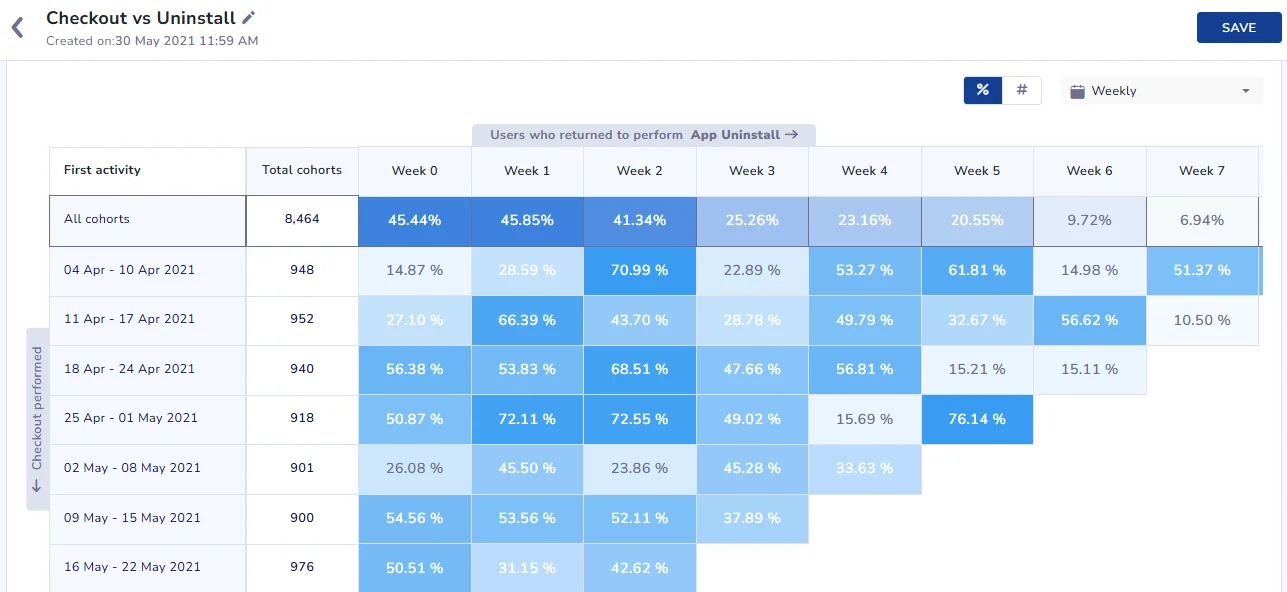

Analyze uninstalls & churn windows: Act on early signals

Every app has critical churn windows: Week 1, Day 30, or post-trial expiry.

Netcore Cohorts don’t just show who churned. They show when and how churn risk peaks. You’ll see:

- Which cohorts uninstall faster than others

- At what day or week churn accelerates

- How long “at-risk” users typically take before going dormant

Benefit: A fintech app may find that users who don’t complete KYC by Day 7 almost never return. With that insight, the brand can launch Day 2, Day 4, and Day 6 reminder campaigns, improving KYC completion and reducing churn in one move.

Turn Cohort Analysis into instant campaigns

Here’s where Netcore Cohorts excels.

Most tools stop at reporting. You export a CSV, hand it to another team, and hope campaigns go out. With Netcore, every cohort is a live segment you can save, sync, and target directly.

That means:

- No copy-pasting data between dashboards

- No delays between seeing a problem and fixing it

- No guesswork on targeting

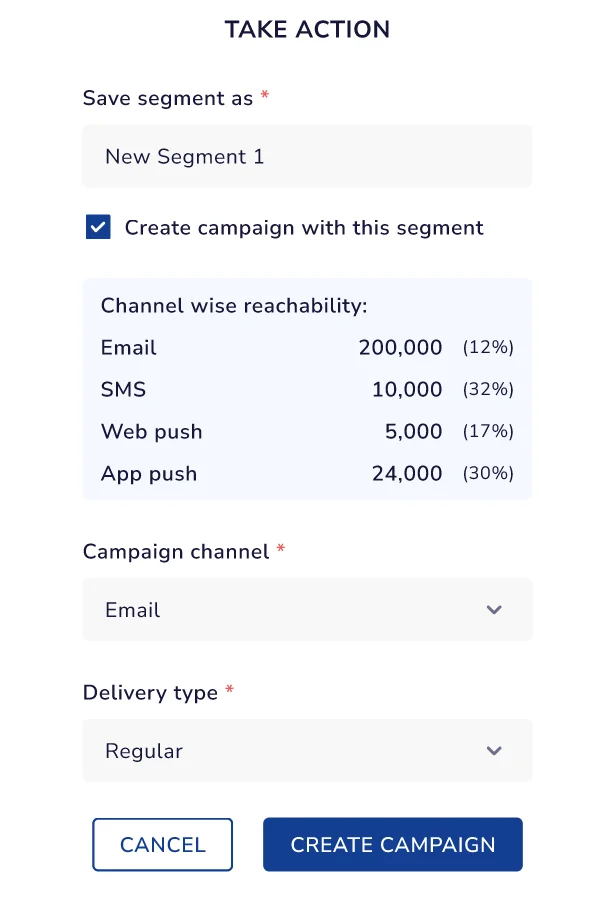

Netcore Cohorts shows you channel-wise reachability and campaign creation all within the cohorts interface.

Benefit in action: An ecommerce app sees week 2 repurchases are dropping for younger age groups. Instead of exporting data, instantly create a campaign to address this issue from the Cohorts screen itself to send targeted campaigns before they forget about your brand.

Unlock the power of Netcore Cohorts: Key use cases

Ecommerce: Identify which product categories lead to higher repeat purchases. Let’s say users who bought from “Activewear” repurchase within 2 weeks, while “Formalwear” buyers return after 4 weeks. Use this insight to time loyalty campaigns or upsell flows based on cohort behavior.

FinTech: Track how long users stay active after onboarding across age groups. For example, young users who complete KYC drop off after 7 days, but older users stay around for up to 14 days. Use this insight to trigger re-engagement nudges between Day 5 and 15 and extend retention.

Travel: Track repeat booking patterns across domestic vs international travel cohorts. If international travelers rebook every 6 months while domestic travelers return in 3, tailor campaigns and loyalty offers based on cohort timelines.

The Netcore difference

Here’s what makes Netcore Cohorts stand out:

- Reachability insight: Know channel-wise reachability before sending the campaign.

- Actionability first: Save cohorts as live segments and launch campaigns instantly.

- Deeper granularity: Segment by technographics, affinities, or uninstall patterns — not just generic “Day 7 retention.”

- Segment comparison: Compare different segments to uncover how cohorts perform across different segments.

If you haven’t explored Netcore Cohorts recently, it’s time. This is no longer a dashboard feature—it’s a revenue-driving engine. Contact your CSM to get started.

If you’re new, see Cohorts in action and get a demo.

Growth, decoded: Agentic Marketing Predictions 2026 for consumer markets. Read the report now.

Growth, decoded: Agentic Marketing Predictions 2026 for consumer markets. Read the report now.