In the high-stakes world of fintech, the first few minutes of a user’s app experience are make-or-break. And the KYC (Know Your Customer) process—while vital—is often the most friction-filled stage, causing users to abandon ship before they even get started.

For BFSI and fintech players, streamlining KYC isn’t just a nice-to-have—it’s business-critical. Whether it’s for digital savings accounts, loan applications, or investment platforms, a seamless KYC journey directly impacts user acquisition, retention, and compliance.

While conversions are the real issue, cutting risk checks isn’t the solution. Over 60% of brands faced $250K+ fines for skipping critical KYC steps during fast-track onboarding.

This blog discusses how BFSI and fintech brands can reimagine their KYC flows using personalization, behavioral insights, and omnichannel automation that turn tedious verifications into smooth, conversion-friendly experiences.

Why KYC is Still a Conversion Killer: Bottlenecks and Business Impact for Fintech Apps

For fintech and BFSI brands, the Know Your Customer (KYC) process is more than just a regulatory checkbox—it’s the gateway to onboarding, monetization, and long-term trust. Yet, despite advancements in digital infrastructure, KYC completion remains one of the most common points of user drop-off during onboarding. Let’s break down why KYC onboarding creates friction in the customer journey and how failing to address it impacts your bottom line.

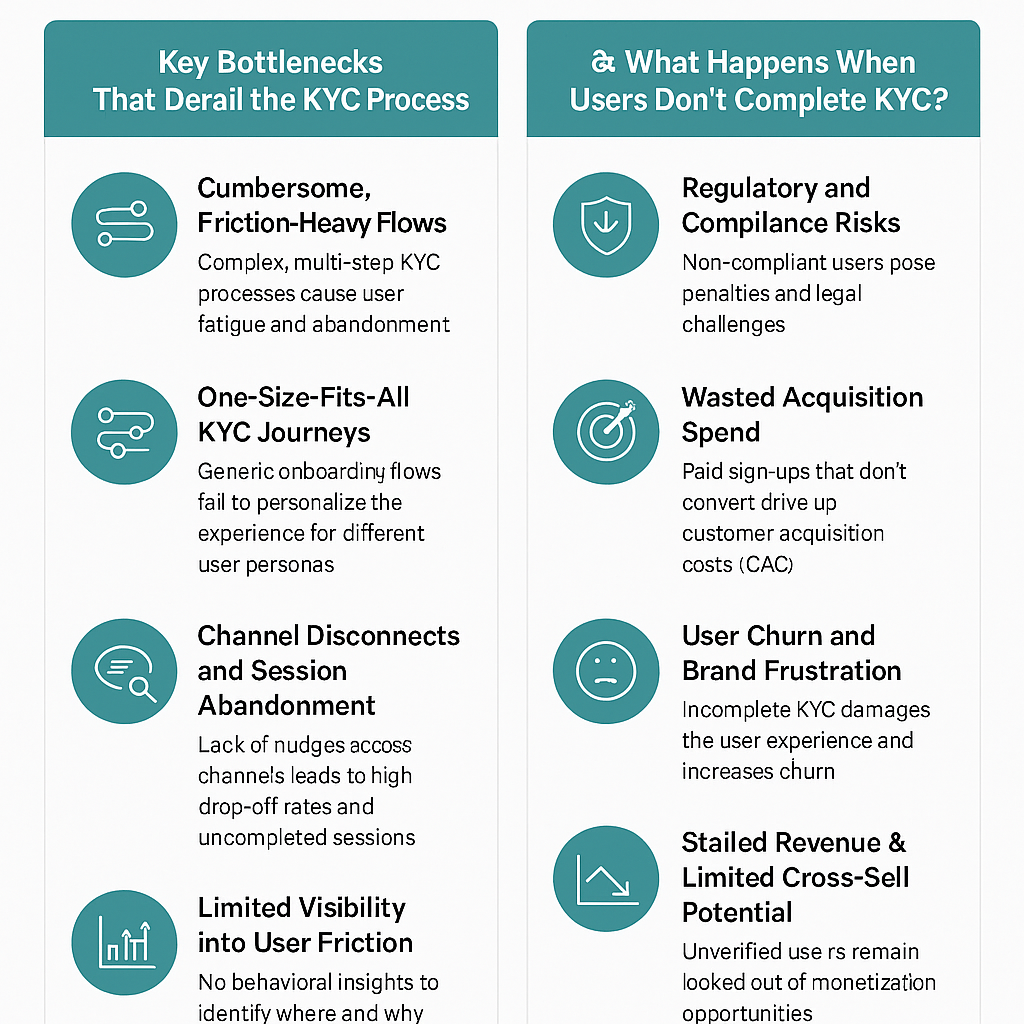

Key Bottlenecks That Derail the KYC Process

1. Cumbersome, Friction-Heavy Flows

Many fintech apps require users to navigate multi-step KYC processes without intuitive UX/UI support. Uploading documents, recording live selfies, or switching to third-party video verification apps introduces friction, especially if:

- There are no clear progress indicators

- Instructions are vague or technical

- The mobile experience is not optimized for low-end devices or unstable networks

This often leads to cognitive overload, fatigue, and confusion, causing users to abandon the flow halfway through.

2. One-Size-Fits-All KYC Journeys

Not every user fits the same profile, yet many platforms serve up identical KYC steps for vastly different personas. Whether a user is a student opening their first digital wallet or an SME applying for a business credit line, treating them the same way results in:

- Irrelevant messaging or documentation requests

- Higher chances of miscommunication or delay

- Missed opportunities to fast-track low-risk users

A lack of personalization makes the process feel bureaucratic and impersonal—pushing users away instead of drawing them in.

3. Channel Disconnects and Session Abandonment

Users often start KYC in one session but drop off due to interruptions, app fatigue, or missing documents. Without intelligent re-engagement across channels, they’re unlikely to return. Common problems include:

- No reminders or follow-ups post drop-off

- No seamless way to resume KYC from where they left off

- Lack of nudges on preferred channels like WhatsApp or push notifications

These micro-moments of abandonment compound over time, significantly lowering conversion rates.

4. Limited Visibility into User Friction

Without real-time behavioral insights, fintech brands struggle to identify where and why users drop out. They rely on assumptions rather than data, which results in:

- Ineffective A/B tests

- Generic, reactive support messages

- Slow iteration cycles in fixing broken steps

What Happens When Users Don’t Complete KYC?

Incomplete KYC doesn’t just stall onboarding—it has serious downstream consequences across multiple areas of your business.

1. Regulatory and Compliance Risks

Incomplete KYC equates to non-compliant users. Depending on the product (e.g., lending, investments, insurance), this could:

- Prevent transaction access or wallet activation

- Lead to violations of RBI or SEBI mandates

- Trigger audits, penalties, or even app store takedowns

In a highly regulated environment, sloppy KYC handling is a liability.

2. Wasted Acquisition Spend

Fintech brands often invest heavily in performance marketing to drive app installs and sign-ups. But if KYC isn’t completed:

- These users can’t be monetized

- CAC (Customer Acquisition Cost) increases without ROI

- Marketing teams report high MQL-to-Customer drop-off

You’re essentially paying to acquire users you can’t convert.

3. User Churn and Brand Frustration

Every incomplete KYC is a lost opportunity for building long-term customer relationships. When users feel frustrated by your onboarding:

- They’re unlikely to return or recommend your service

- They may switch to competitors with smoother flows

- Negative app reviews citing “poor signup experience” hurt brand perception

A clunky KYC experience can ruin first impressions and damage trust permanently.

4. Stalled Revenue & Limited Cross-Sell Potential

Without a completed KYC, users remain stuck in a “read-only” version of your app:

- No account activation means no payments, no lending, no investments

- You can’t offer personalized financial products or cross-sells

- Revenue from these users remains at zero, despite initial intent

It’s like getting someone to your store but locking the shelves.

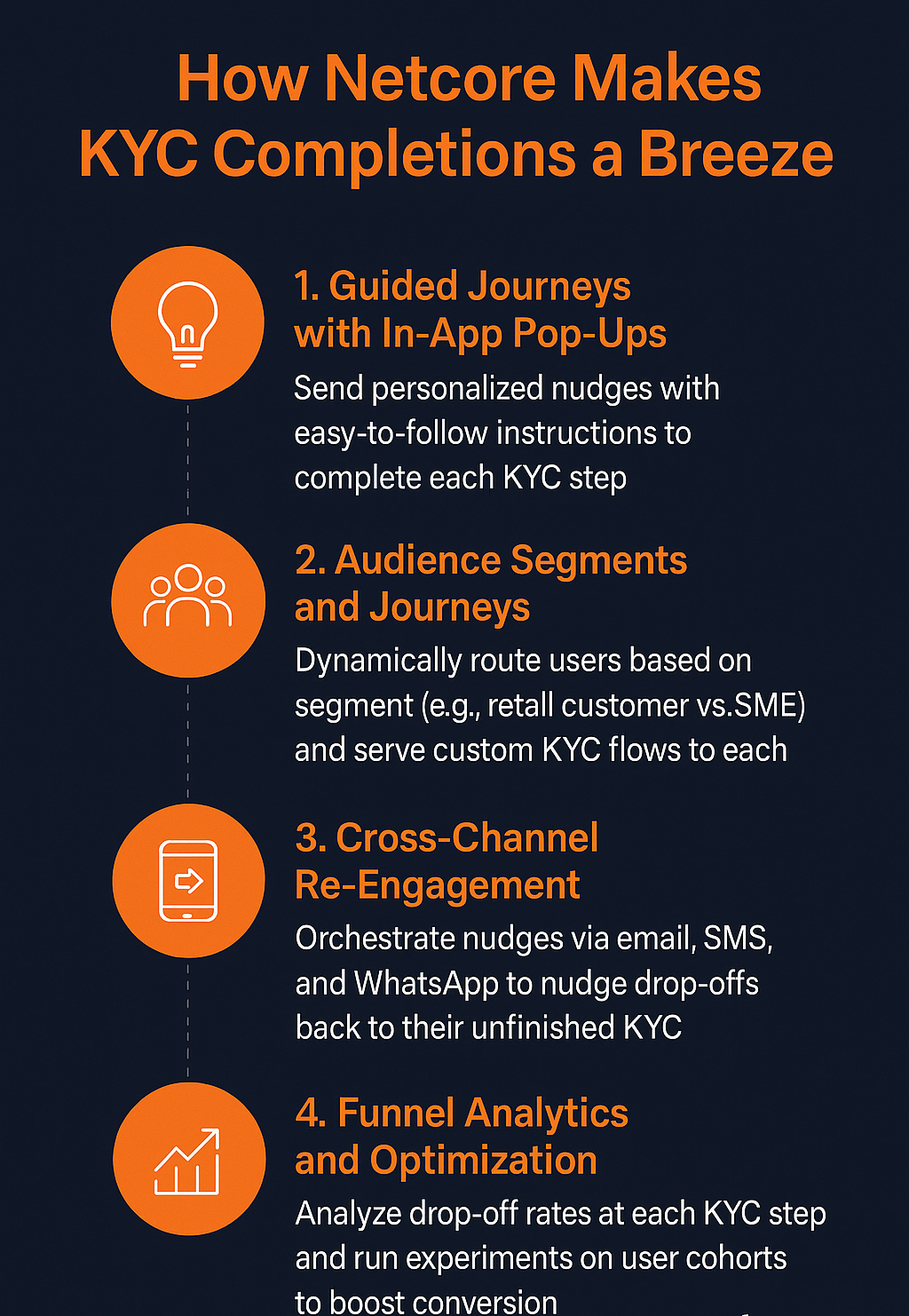

How to Make KYC Completions a Breeze with Netcore

Netcore’s customer engagement platform empowers fintechs to remove friction from the KYC process through a combination of real-time behavioral intelligence, AI-led personalization, and automated, omnichannel orchestration.

Here’s how each of Netcore’s key capabilities contributes to significantly improving KYC completion rates:

1. Hyper-Personalized Onboarding Journeys with AI-Led Journey Orchestration

Traditional onboarding flows are linear and rigid. But with Netcore’s AI-powered journey orchestration platform, fintech brands can dynamically adapt the onboarding path based on each user’s context and behavior.

How it works:

- Personalize flows based on user persona, such as salaried vs. self-employed, urban vs. rural, and app vs. web traffic.

- Dynamically adjust CTAs or screens depending on KYC progress—for example, simplifying document upload options if a user struggles.

- Use zero-party and first-party data (collected during signup or via surveys) to trigger contextual next steps (e.g., recommending DigiLocker if a user doesn’t upload PAN).

Benefits:

- Drastically reduces cognitive load and abandonment.

- Creates a ‘white-glove’ onboarding experience that feels tailored, not transactional.

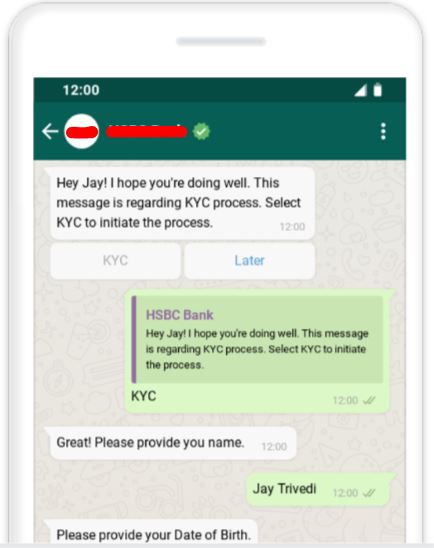

2. Omnichannel Engagement with Real-Time Nudges & Reminders

When users drop off mid-KYC, time is of the essence. Netcore omnichannel marketing enables real-time, event-triggered communication across the most effective user-preferred channels, including:

3. Interactive AMP Email

How it works:

- Set up real-time triggers for key actions: document not uploaded, selfie skipped, inactivity after 60 seconds on KYC screen.

- Automate gentle nudges that resume the journey from the exact point of drop-off.

- Localize and personalize messages for greater relevance (e.g., language preference, user location).

Example:

A user who abandons mid-KYC receives a WhatsApp nudge saying,

“Hi Meena! You’re almost there. Just 1 more step to verify your Aadhaar and activate your account in minutes.”

Benefits:

- Re-engages users when intent is still high.

- Drives faster completions with fewer drop-offs.

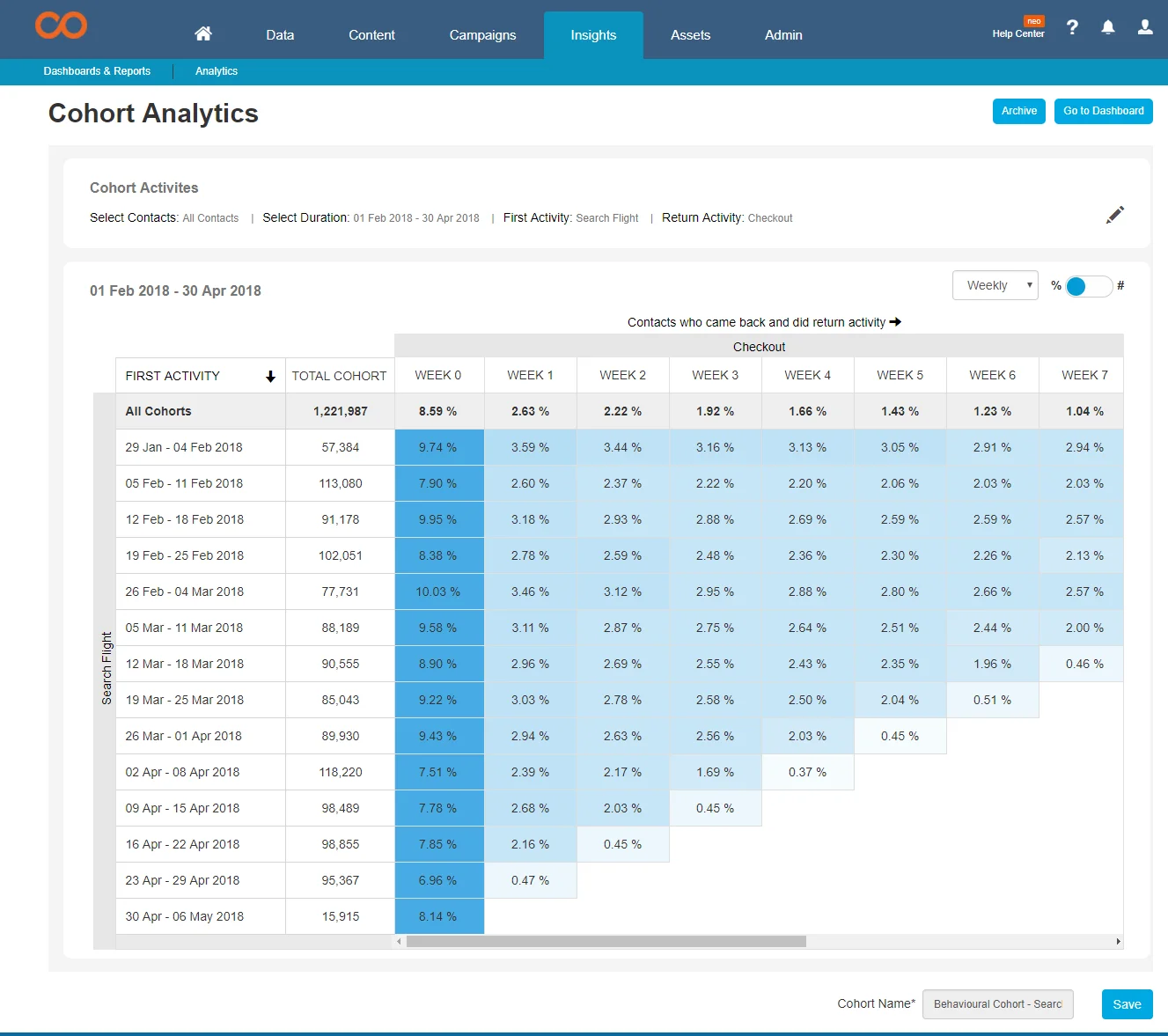

3. Deep Behavioral Analytics and Micro-Segmentation

KYC drop-offs often stem from hidden friction points. Netcore’s in-app behavioral analytics helps decode exactly where and why users abandon the KYC flow, allowing fintechs to fix these issues proactively.

How it works:

- Analyse the user journey to build segments such as “users who drop off after selfie stage” or “users who retry video KYC twice.”

- Segment audience and create automated journeys at every stage of the KYC funnel and send triggered messages on the customer’s preferred channel.

- Use insights to test and roll out optimized flows, such as simplifying form fields or providing guided walkthroughs.

Benefits:

- Identifies high-friction steps backed by data, not guesswork.

- Powers ongoing UX optimization to improve funnel conversion.

4. Marketing Automation & Lifecycle Journeys to Recover Drop-Offs

KYC isn’t always completed in one session—and that’s okay. Netcore’s visual journey builder allows fintechs to design multi-day, automated re-engagement sequences that guide users back to completion without manual intervention.

How it works:

- Use cohort retention analysis to identify user drop-off from day 0 to day 30.

- Create automated journeys with timed nudges over 1, 3, and 7 days post drop-off.

- Add branching logic: if a user opens push but doesn’t act, follow up via Email.

Example:

Day 1: Push notification →

Day 2: WhatsApp message with personalized link →

Day 3: SMS + email with a urgency for completing KYC

Benefits:

– Turns “cold leads” into converted customers with minimal effort.

– Frees up operational teams while ensuring consistent follow-through.

Bonus: Pre-Built KYC Campaign Templates & Integration Support

Netcore provides BFSI and fintech brands with ready-to-use KYC journey templates and easy API integrations with core banking/KYC verification systems, ensuring:

- Faster go-live with best practices embedded

- Seamless integration with DigiLocker, Aadhaar, PAN, and CKYC providers

- Ability to trigger personalized KYC journeys immediately after a signup event

Final Result?

With these capabilities, Netcore transforms KYC from a conversion-killer into a conversion catalyst. Clients experience:

- 20–35% uplift in KYC completions

- Shorter onboarding times by up to 40%

- Higher Day 1 activation and retention rates

Conclusion

In fintech, first impressions count—and KYC is your digital handshake. Making this process intuitive, fast, and personalized is the surest way to win user trust and unlock lifetime value.

Netcore offers the tech, strategy, and automation muscle to help you turn KYC from a roadblock into a revenue accelerator.

👉 Ready to optimize your KYC flow? Let’s talk.

Worried About Your AI Marketing Strategy? Read the Agentic Marketing 2026 Predictions Report! →

Worried About Your AI Marketing Strategy? Read the Agentic Marketing 2026 Predictions Report! →